Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339 Exercise 11

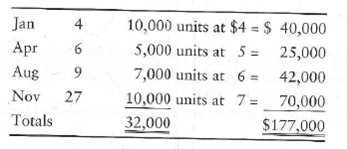

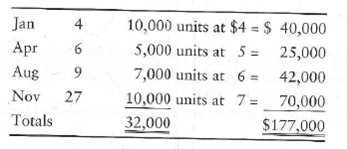

Suppose you are an investment advisor, and you are looking at two companies to recommend to your clients, Shelly's Seashell Enterprises and Jeremy Feigenbaum Systems. The two companies are virtually identical, and both began operations at the beginning of the current year. During the year, each company purchased inventory as follows:

During the first year, both companies sold 25,000 units of inventory.

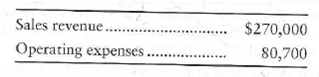

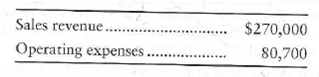

In early January, both companies purchased equipment costing $143,000, with a 10-year estimated useful life and a $20,000 residual value. Shelly uses the inventory and depreciation methods that maximize reported income (FIFO and straight-line). By contrast, Feigenbaum uses the inventory and depreciation methods that minimize income taxes (LIFO and double-declining-balance). Both companies' trial balances at December 31, 2013, included the following:

Requirements

1. Prepare both companies' income statements. (Disregard income tax expense.)

2. Write an investment letter to address the following questions for your clients: Which company appears to be more profitable Which company has more cash to invest in new projects Which company would you prefer to invest in Why

During the first year, both companies sold 25,000 units of inventory.

In early January, both companies purchased equipment costing $143,000, with a 10-year estimated useful life and a $20,000 residual value. Shelly uses the inventory and depreciation methods that maximize reported income (FIFO and straight-line). By contrast, Feigenbaum uses the inventory and depreciation methods that minimize income taxes (LIFO and double-declining-balance). Both companies' trial balances at December 31, 2013, included the following:

Requirements

1. Prepare both companies' income statements. (Disregard income tax expense.)

2. Write an investment letter to address the following questions for your clients: Which company appears to be more profitable Which company has more cash to invest in new projects Which company would you prefer to invest in Why

Explanation

1. This exercise requires application of...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255