Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339 Exercise 10

Capitalized asset cost and partial year depreciation

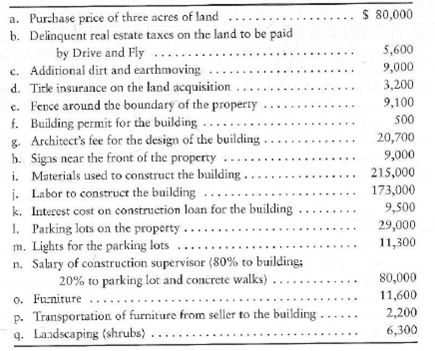

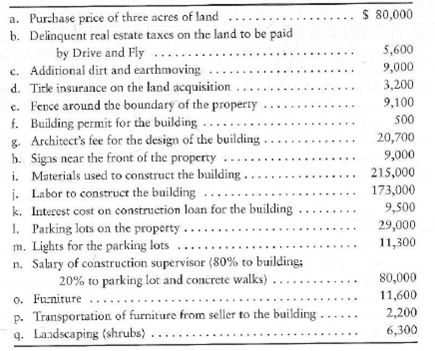

Drive and Fly, near an airport, incurred the following costs to acquire land, make land improvements, and construct and furnish a small building:

Drive and Fly depreciates land improvements over 20 years, buildings over 40 years, and furniture over 10 years, all on a straight-line basis with zero residual value.

Requirements

1. Set up columns for Land, Land Improvements, Building, and Furniture. Show how to account for each cost by listing the cost under the correct account. Determine the total cost of each asset.

2. AH construction was complete and the assets were placed in service on July 1. Record partial-year depreciation for the year ended December 31.

Drive and Fly, near an airport, incurred the following costs to acquire land, make land improvements, and construct and furnish a small building:

Drive and Fly depreciates land improvements over 20 years, buildings over 40 years, and furniture over 10 years, all on a straight-line basis with zero residual value.

Requirements

1. Set up columns for Land, Land Improvements, Building, and Furniture. Show how to account for each cost by listing the cost under the correct account. Determine the total cost of each asset.

2. AH construction was complete and the assets were placed in service on July 1. Record partial-year depreciation for the year ended December 31.

Explanation

1. This exercise requires application of...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255