Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339 Exercise 28

Capitalized asset cost and partial year depreciation

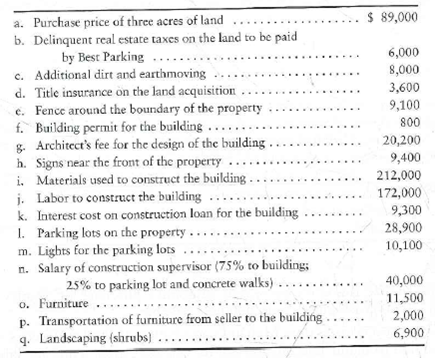

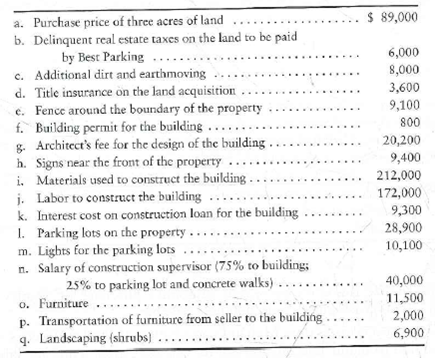

Best Parking, near an airport, incurred the following costs to acquire land, make land improvements, and construct and furnish a small building:

Best Parking depreciates land improvements over 25 years, buildings over 50 years, and furniture over 12 years, all on a straight-line basis with zero residual value.

Requirements

1. Set up columns for Land, Land Improvements, Building, and Furniture. Show how to account for each cost by listing the cost under the correct account. Determine the total cost of each asset.

2. All construction was complete and the assets were placed in service on July 1. Record partial-year depreciation for the year ended December 31.

Best Parking, near an airport, incurred the following costs to acquire land, make land improvements, and construct and furnish a small building:

Best Parking depreciates land improvements over 25 years, buildings over 50 years, and furniture over 12 years, all on a straight-line basis with zero residual value.

Requirements

1. Set up columns for Land, Land Improvements, Building, and Furniture. Show how to account for each cost by listing the cost under the correct account. Determine the total cost of each asset.

2. All construction was complete and the assets were placed in service on July 1. Record partial-year depreciation for the year ended December 31.

Explanation

1. This exercise requires appl...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255