Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339 Exercise 11

Analyzing, journalizing, and reporting bond transactions

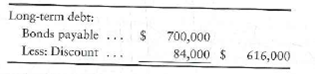

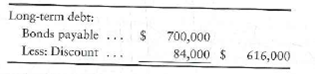

Danny's Hamburgers, Inc., issued 9%, 10-year bonds payable at 85 on December 31, 2010. At December 31, 2012, Danny reported the bonds payable as follows:

Danny uses the straight-line amortization method and pays semiannual interest each Tune 30 and December 31.

Requirements

1. Answer the following questions about Danny's bonds payable:

a. What is the maturity value of the bonds

b. What is the carrying amount of the bonds at December 31, 2012

c. What is the annual cash interest payment on the bonds

d. How much interest expense should the company record each year

2. Record the June 30, 2013, semiannual interest payment and amortization of discount.

3. What will be the carrying amount of the bonds at December 31, 2013

Danny's Hamburgers, Inc., issued 9%, 10-year bonds payable at 85 on December 31, 2010. At December 31, 2012, Danny reported the bonds payable as follows:

Danny uses the straight-line amortization method and pays semiannual interest each Tune 30 and December 31.

Requirements

1. Answer the following questions about Danny's bonds payable:

a. What is the maturity value of the bonds

b. What is the carrying amount of the bonds at December 31, 2012

c. What is the annual cash interest payment on the bonds

d. How much interest expense should the company record each year

2. Record the June 30, 2013, semiannual interest payment and amortization of discount.

3. What will be the carrying amount of the bonds at December 31, 2013

Explanation

1. This exercise requires application of...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255