Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339 Exercise 44

Preparing the statement of cash flows-direct method

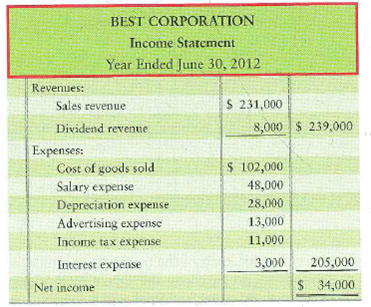

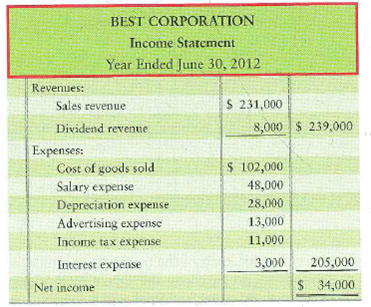

The income statement and additional data of Best Corporation follow:

Additional data follow:

a. Collections from customers are $15,500 more than sales.

b. Dividend revenue, interest expense, and income tax expense equal their cash amounts.

c. Payments to suppliers are the sum of cost of goods sold plus advertising expense.

d. Payments to employees are $1,000 more than salary expense.

c. Acquisition of plant assets is $102,000.

f. Cash receipts from sale of land total $24,000.

g. Cash receipts from issuance of common stock total $32,000.

h. Payment of long-term note payable is $17,000.

i. Payment of dividends is $10,500.

j. Cash balance, June 30, 2011, was $25,000; June 30, 2012 was $28,000.

Requirement

1. Prepare Best Corporation's statement of cash flows for the year ended June 30, 2012. Use the direct method

The income statement and additional data of Best Corporation follow:

Additional data follow:

a. Collections from customers are $15,500 more than sales.

b. Dividend revenue, interest expense, and income tax expense equal their cash amounts.

c. Payments to suppliers are the sum of cost of goods sold plus advertising expense.

d. Payments to employees are $1,000 more than salary expense.

c. Acquisition of plant assets is $102,000.

f. Cash receipts from sale of land total $24,000.

g. Cash receipts from issuance of common stock total $32,000.

h. Payment of long-term note payable is $17,000.

i. Payment of dividends is $10,500.

j. Cash balance, June 30, 2011, was $25,000; June 30, 2012 was $28,000.

Requirement

1. Prepare Best Corporation's statement of cash flows for the year ended June 30, 2012. Use the direct method

Explanation

Statement of cash flow:

Before we pre...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255