Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339 Exercise 6

Using ratios to evaluate a stock investment

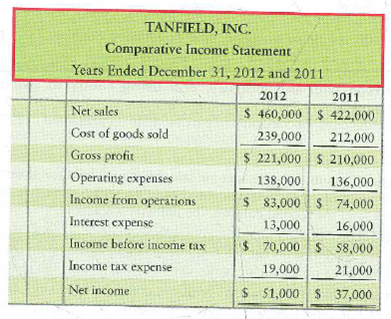

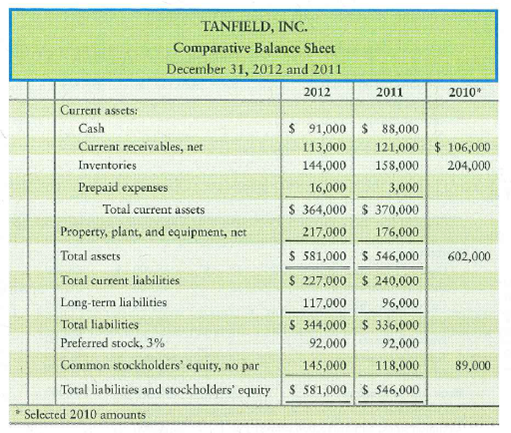

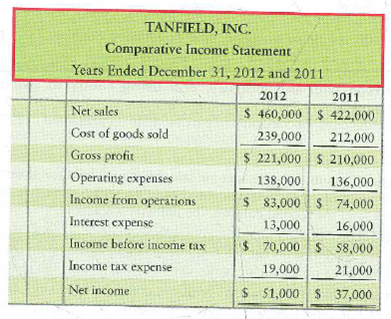

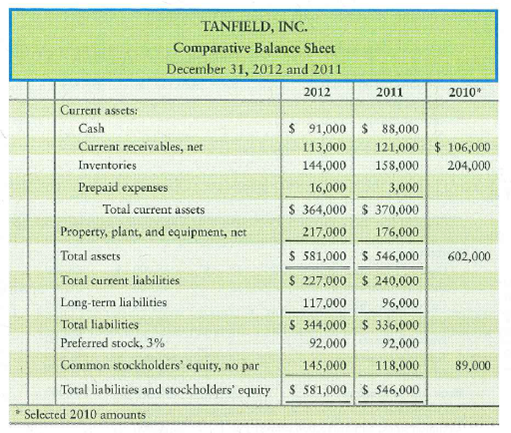

Comparative financial statement data of Tanfield, Inc., follow:

1. Market price of Tanfield's common stock: $59.36 at December 31, 2012, and $46.65 at December 31, 2011.

2. Common shares outstanding: 13,000 during 2012 and 11,000 during 2011 and 2010.

3. All sales on credit.

Requirements

1. Compute the following ratios for 2012 and 2011:

a. Current ratio

b. Times-interest-earned ratio

c. Inventory turnover

d. Gross profit percentage

e. Debt to equity ratio

f. Rate of return on common stockholders' equity

g. Earnings per share of common stock

h. Price/earnings ratio

2. Decide (a) whether Tanfield's ability to pay debts and to sell inventory improved or deteriorated during 2012 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased.

Comparative financial statement data of Tanfield, Inc., follow:

1. Market price of Tanfield's common stock: $59.36 at December 31, 2012, and $46.65 at December 31, 2011.

2. Common shares outstanding: 13,000 during 2012 and 11,000 during 2011 and 2010.

3. All sales on credit.

Requirements

1. Compute the following ratios for 2012 and 2011:

a. Current ratio

b. Times-interest-earned ratio

c. Inventory turnover

d. Gross profit percentage

e. Debt to equity ratio

f. Rate of return on common stockholders' equity

g. Earnings per share of common stock

h. Price/earnings ratio

2. Decide (a) whether Tanfield's ability to pay debts and to sell inventory improved or deteriorated during 2012 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased.

Explanation

b.

We know that the company's income fro...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255