Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Edition 8ISBN: 978-1305585454

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Edition 8ISBN: 978-1305585454 Exercise 47

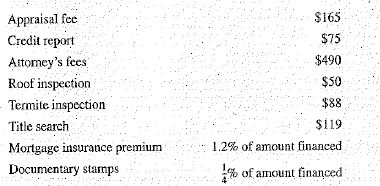

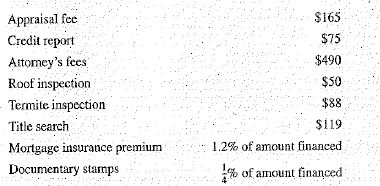

Adam Marsh is purchasing a $134,000 condominium apartment. The down payment is 20%, and the balance will be financed with a 20-year fixed-rate mortgage at 8.75% and 3 discount points. The annual property tax is $1,940, and the hazard insurance premium is $1,460. When Adam signed the original sales contract, he put down a deposit of $10,000, which will be credited to his down payment. In addition, at the time of closing, he must pay the following expenses:

As Adam's real estate agent, he has asked you the following questions:

a. What is the total monthly PITI of the mortgage loan

b. What is the total amount of interest that Adam will pay on the loan

c. How much is due at the time of the closing

d. If the sellers are responsible for the 6% broker's commission, $900 in closing costs, and the existing first mortgage with a balance of $45,000, what proceeds will be received on the sale of the property

As Adam's real estate agent, he has asked you the following questions:

a. What is the total monthly PITI of the mortgage loan

b. What is the total amount of interest that Adam will pay on the loan

c. How much is due at the time of the closing

d. If the sellers are responsible for the 6% broker's commission, $900 in closing costs, and the existing first mortgage with a balance of $45,000, what proceeds will be received on the sale of the property

Explanation

Consider the cost of house is

, the d...

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255