Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Edition 8ISBN: 978-1305585454

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Edition 8ISBN: 978-1305585454 Exercise 18

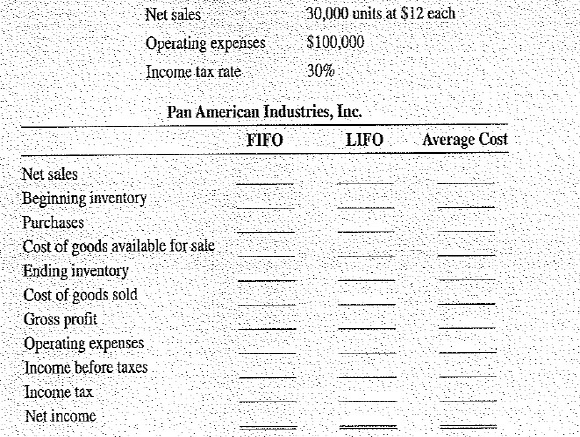

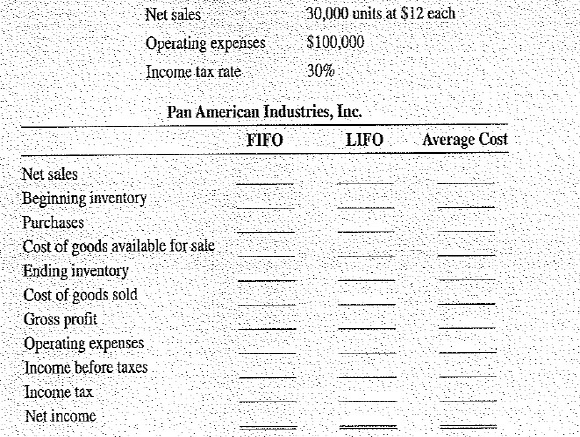

You are the chief accountant of Pan American Industries, inc. In anticipation of the upcoming annual stockholders' meeting, the president of the company asked you to determine the effect of the FIFO, LIFO, and average inventory valuation methods on the company's income statement.

Beginning inventory, January 1, was 10,000 units at $5 each. Purchases during the year consisted of 15,000 units at $6 on April 15, 20,000 units at $7 on July 19, and 25,000 units at $8 on November 2.

a. If ending inventory on December 31 was 40,000 units, calculate the value of this inventory by using the three valuation methods.

FIFO: _____ LIFO: _____ Average Cost: _____

b. Calculate the income statement items below for each of the inventory valuation methods.

c. Which inventory method should be used if the objective is to pay the least amount of taxes

d. Which inventory method should be used if the objective is to show the greatest amount of profit in the annual report to the shareholders

Beginning inventory, January 1, was 10,000 units at $5 each. Purchases during the year consisted of 15,000 units at $6 on April 15, 20,000 units at $7 on July 19, and 25,000 units at $8 on November 2.

a. If ending inventory on December 31 was 40,000 units, calculate the value of this inventory by using the three valuation methods.

FIFO: _____ LIFO: _____ Average Cost: _____

b. Calculate the income statement items below for each of the inventory valuation methods.

c. Which inventory method should be used if the objective is to pay the least amount of taxes

d. Which inventory method should be used if the objective is to show the greatest amount of profit in the annual report to the shareholders

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255