Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Edition 8ISBN: 978-1305585454

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Edition 8ISBN: 978-1305585454 Exercise 4

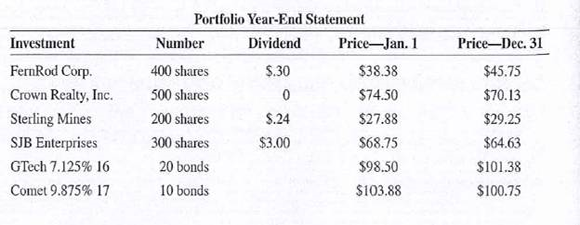

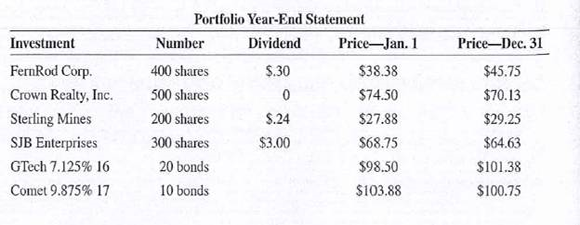

You have received your investment portfolio year-end statement from your broker, Rich Waldman. All investments were purchased at the January prices and held the entire year.

a. Calculate how much profit or loss you made for the year, including stock dividends and bond interest.

b. What was the total return on investment for your portfolio

c. Using a broker's commission of 3% buying and 3% selling on the stocks and $5 buying and $5 selling per bond, how much profit or loss would you make if you liquidated your entire portfolio at the December 31 prices

d. What would be the return on investment

a. Calculate how much profit or loss you made for the year, including stock dividends and bond interest.

b. What was the total return on investment for your portfolio

c. Using a broker's commission of 3% buying and 3% selling on the stocks and $5 buying and $5 selling per bond, how much profit or loss would you make if you liquidated your entire portfolio at the December 31 prices

d. What would be the return on investment

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255