M&B3 3rd Edition by Dean Croushore

Edition 3ISBN: 978-1285167961

M&B3 3rd Edition by Dean Croushore

Edition 3ISBN: 978-1285167961 Exercise 8

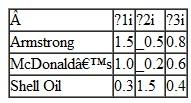

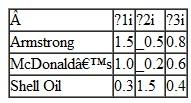

Suppose that the following version of the APT is a good model of risk in the stock market. Consider three factors: the stock market's excess return in percentage points, the change over the last year in the price of oil in dollars, and the spread between 10-year Treasury bonds and three-month Treasury bills in percentage points. Suppose that the stock market's average excess return is 9 percent and that the average risk-free interest rate is 1 percent, the average change in the price of oil is $0.25, and the average spread between 10-year Treasury bonds and threemonth Treasury bills is 1.25. Each of the following stocks has the beta coeffi cients shown in the table below:

a What is the expected return to each of the three stocks

a What is the expected return to each of the three stocks

b If the market's excess return were to be above average by 1 percent (that is, it rose 10 percent in a particular year instead of the usual 9 percent), what would you expect the effect to be on the return to each of the three stocks

c If the price of oil were to fall by $3.00 in a particular year (that is, $3.25 less than the average change of _$0.25), what would you expect the effect to be on the return to each of the three stocks

d If the interest-rate spread rose to 2.00 percent in a particular year (that is, 0.75 percentage point higher than average), what would you expect the effect to be on the return to each of the three stocks

a What is the expected return to each of the three stocks

a What is the expected return to each of the three stocks b If the market's excess return were to be above average by 1 percent (that is, it rose 10 percent in a particular year instead of the usual 9 percent), what would you expect the effect to be on the return to each of the three stocks

c If the price of oil were to fall by $3.00 in a particular year (that is, $3.25 less than the average change of _$0.25), what would you expect the effect to be on the return to each of the three stocks

d If the interest-rate spread rose to 2.00 percent in a particular year (that is, 0.75 percentage point higher than average), what would you expect the effect to be on the return to each of the three stocks

Explanation

Under the Arbitrage Price Theory the rat...

M&B3 3rd Edition by Dean Croushore

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255