Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 8

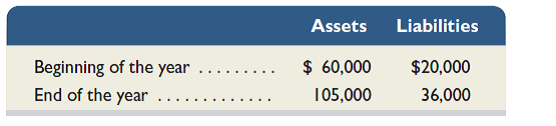

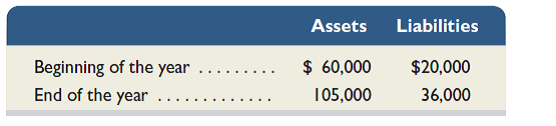

A sole proprietorship had the following assets and liabilities at the beginning and end of this year.

Determine the net income earned or net loss incurred by the business during the year for each of the following separate cases:

a. Owner made no investments in the business and no withdrawals were made during the year.

b. Owner made no investments in the business but withdrew $1,250 cash per month for personal use.

c. Owner made no withdrawals during the year but did invest an additional $55,000 cash.

d. Owner withdrew $1,250 cash per month for personal use and invested an additional $35,000 cash.

Determine the net income earned or net loss incurred by the business during the year for each of the following separate cases:

a. Owner made no investments in the business and no withdrawals were made during the year.

b. Owner made no investments in the business but withdrew $1,250 cash per month for personal use.

c. Owner made no withdrawals during the year but did invest an additional $55,000 cash.

d. Owner withdrew $1,250 cash per month for personal use and invested an additional $35,000 cash.

Explanation

Beginning of the year, assets are $ 60,0...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255