Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 53

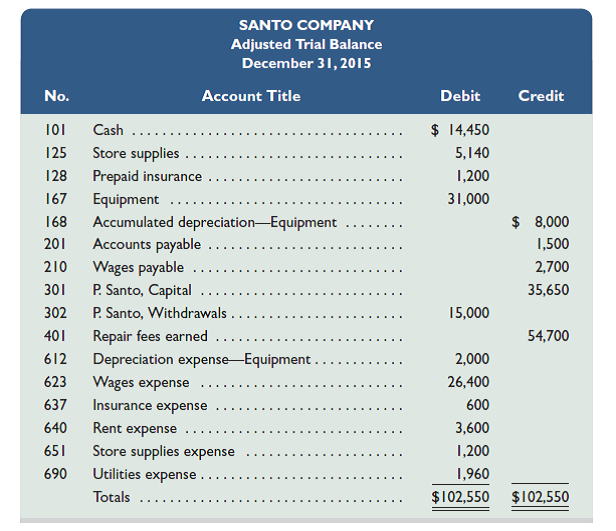

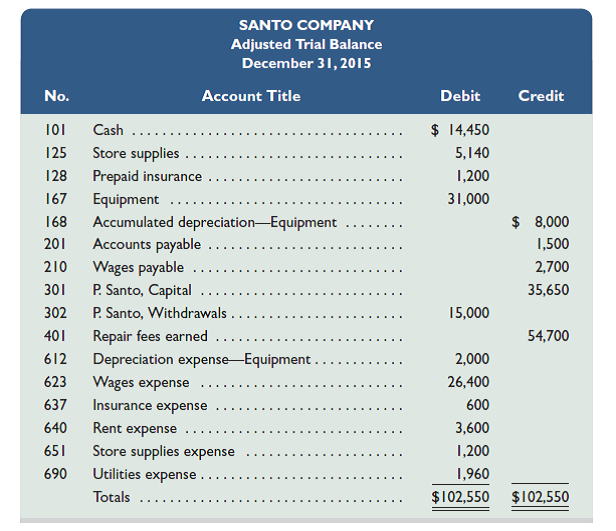

Santo Company's adjusted trial balance on December 31, 2015, follows.

Required

1. Prepare an income statement and a statement of owner's equity for the year 2015, and a classified balance sheet at December 31, 2015. There are no owner investments in 2015.

2. Enter the adjusted trial balance in the first two columns of a six-column table. Use the middle two columns for closing entry information and the last two columns for a post-closing trial balance. Insert an Income Summary account (No. 901) as the last item in the trial balance.

3. Enter closing entry information in the six-column table and prepare journal entries for it.

Analysis Component

4. Assume for this part only that

a. None of the $600 insurance expense had expired during the year. Instead, assume it is a prepayment of the next period's insurance protection.

b. There are no earned and unpaid wages at the end of the year. ( Hint: Reverse the $2,700 wages payable accrual.)

Describe the financial statement changes that would result from these two assumptions.

Required

1. Prepare an income statement and a statement of owner's equity for the year 2015, and a classified balance sheet at December 31, 2015. There are no owner investments in 2015.

2. Enter the adjusted trial balance in the first two columns of a six-column table. Use the middle two columns for closing entry information and the last two columns for a post-closing trial balance. Insert an Income Summary account (No. 901) as the last item in the trial balance.

3. Enter closing entry information in the six-column table and prepare journal entries for it.

Analysis Component

4. Assume for this part only that

a. None of the $600 insurance expense had expired during the year. Instead, assume it is a prepayment of the next period's insurance protection.

b. There are no earned and unpaid wages at the end of the year. ( Hint: Reverse the $2,700 wages payable accrual.)

Describe the financial statement changes that would result from these two assumptions.

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255