Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 43

MLS Company has five employees, each of whom earns $1,600 per month and is paid on the last day of each month. All five have been employed continuously at this amount since January 1. On June 1, the following accounts and balances exist in its general ledger:

a. FICA-Social Security Taxes Payable, $992; FICA-Medicare Taxes Payable, $232. (The balances of these accounts represent total liabilities for both the employer's and employees' FICA taxes for the May payroll only.)

b. Employees' Federal Income Taxes Payable, $1,050 (liability for May only).

c. Federal Unemployment Taxes Payable, $66 (liability for April and May together).

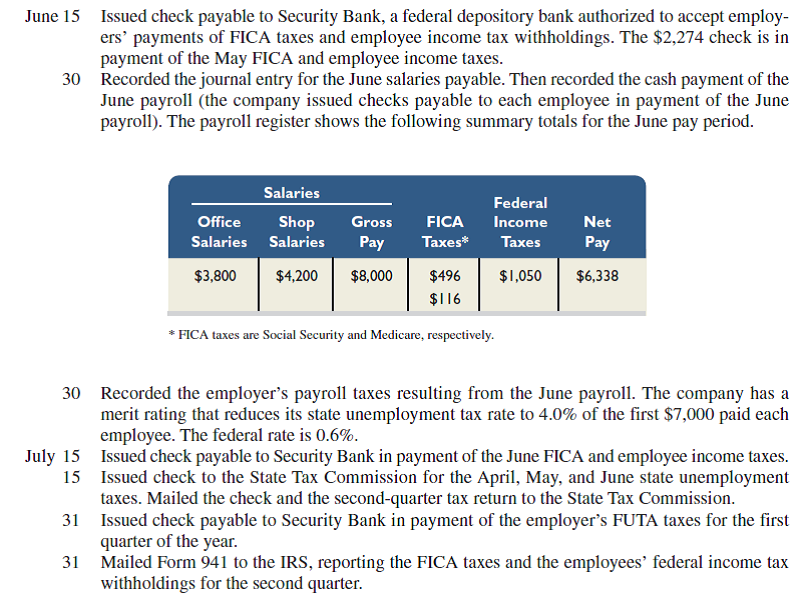

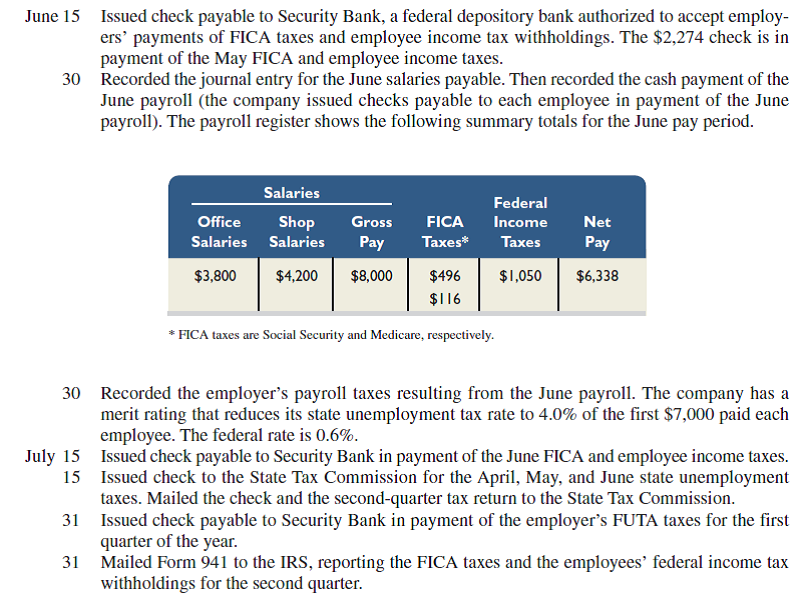

d. State Unemployment Taxes Payable, $440 (liability for April and May together). During June and July, the company had the following payroll transactions.

Required

Prepare journal entries to record the transactions and events for both June and July.

a. FICA-Social Security Taxes Payable, $992; FICA-Medicare Taxes Payable, $232. (The balances of these accounts represent total liabilities for both the employer's and employees' FICA taxes for the May payroll only.)

b. Employees' Federal Income Taxes Payable, $1,050 (liability for May only).

c. Federal Unemployment Taxes Payable, $66 (liability for April and May together).

d. State Unemployment Taxes Payable, $440 (liability for April and May together). During June and July, the company had the following payroll transactions.

Required

Prepare journal entries to record the transactions and events for both June and July.

Explanation

Employer Payroll taxes

Employer is liab...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255