Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 29

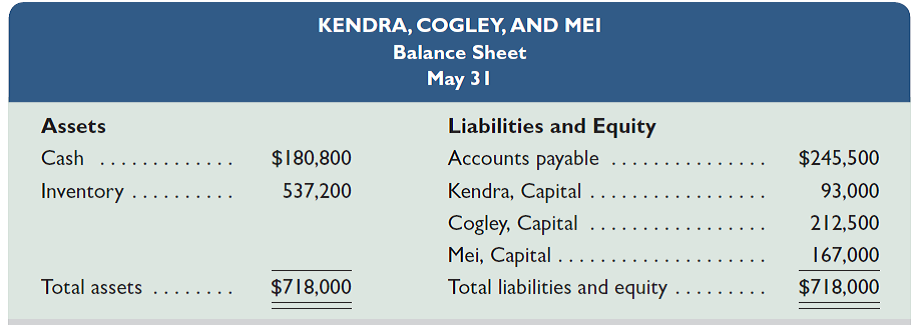

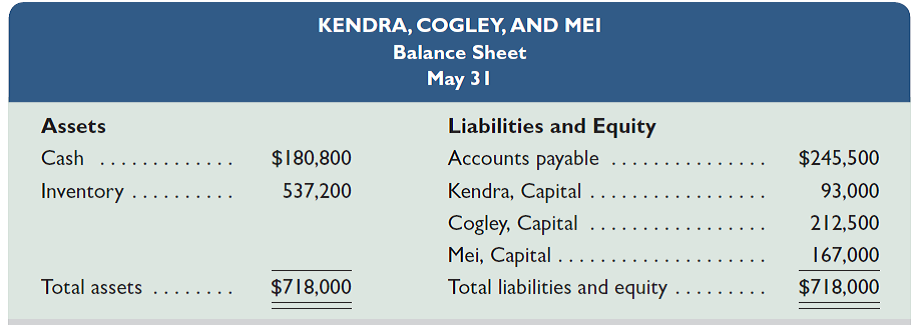

Kendra, Cogley, and Mei share income and loss in a 3:2:1 ratio. The partners have decided to liquidate their partnership. On the day of liquidation their balance sheet appears as follows.

Required

Prepare journal entries for ( a ) the sale of inventory, ( b ) the allocation of its gain or loss, ( c ) the payment of liabilities at book value, and ( d ) the distribution of cash in each of the following separate cases: Inventory is sold for (1) $600,000; (2) $500,000; (3) $320,000 and any partners with capital deficits pay in the amount of their deficits; and (4) $250,000 and the partners have no assets other than those invested in the partnership. (Round to the nearest dollar.)

Required

Prepare journal entries for ( a ) the sale of inventory, ( b ) the allocation of its gain or loss, ( c ) the payment of liabilities at book value, and ( d ) the distribution of cash in each of the following separate cases: Inventory is sold for (1) $600,000; (2) $500,000; (3) $320,000 and any partners with capital deficits pay in the amount of their deficits; and (4) $250,000 and the partners have no assets other than those invested in the partnership. (Round to the nearest dollar.)

Explanation

Journal entries

All the financial trans...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255