Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 32

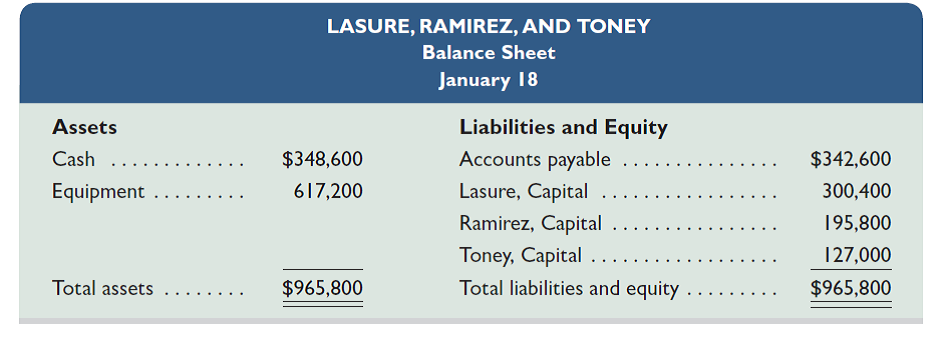

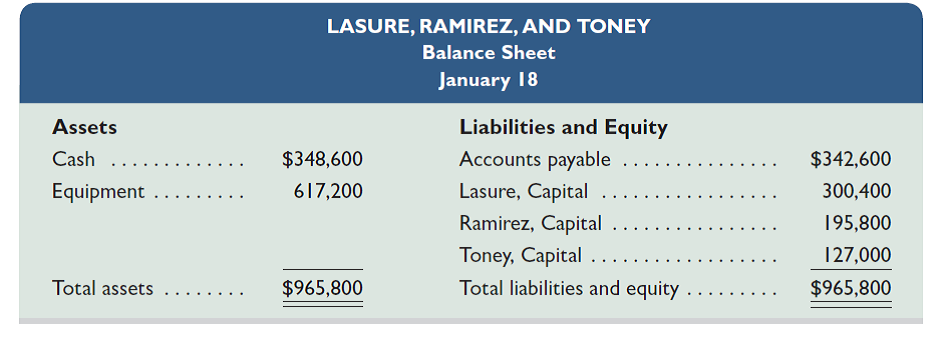

Lasure, Ramirez, and Toney, who share income and loss in a 2:1:2 ratio, plan to liquidate their partnership. At liquidation, their balance sheet appears as follows.

Required

Prepare journal entries for ( a ) the sale of equipment, ( b ) the allocation of its gain or loss, ( c ) the payment of liabilities at book value, and ( d ) the distribution of cash in each of the following separate cases: Equipment is sold for (1) $650,000; (2) $530,000; (3) $200,000 and any partners with capital deficits pay in the amount of their deficits; and (4) $150,000 and the partners have no assets other than those invested in the partnership. (Round amounts to the nearest dollar.)

Required

Prepare journal entries for ( a ) the sale of equipment, ( b ) the allocation of its gain or loss, ( c ) the payment of liabilities at book value, and ( d ) the distribution of cash in each of the following separate cases: Equipment is sold for (1) $650,000; (2) $530,000; (3) $200,000 and any partners with capital deficits pay in the amount of their deficits; and (4) $150,000 and the partners have no assets other than those invested in the partnership. (Round amounts to the nearest dollar.)

Explanation

Journal entries

All the financial trans...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255