Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 37

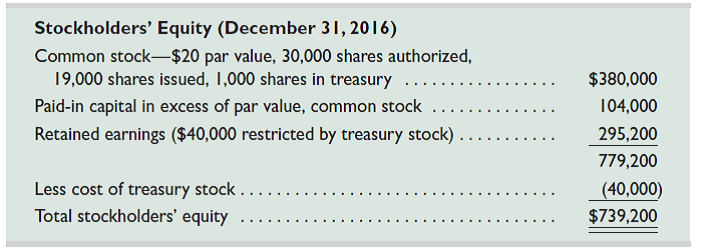

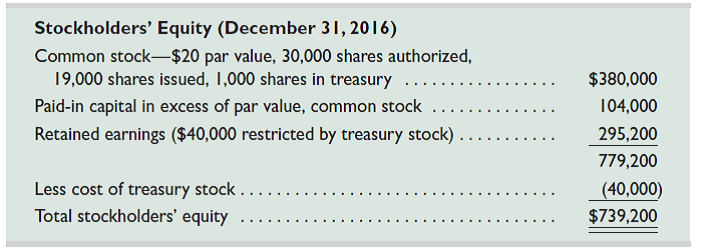

The equity sections from Hovo Corporation's 2015 and 2016 balance sheets follow.

The following transactions and events affected its equity during year 2016.

Feb. 15 Declared a $0.40 per share cash dividend, date of record five days later.

Mar. 2 Purchased treasury stock for cash.

May 15 Declared a $0.40 per share cash dividend, date of record five days later.

Aug. 15 Declared a $0.40 per share cash dividend, date of record five days later.

Oct. 4 Declared a 12.5% stock dividend when the stock's market value is $42 per share.

Oct. 20 Issued the stock dividend that was declared on October 4.

Nov. 15 Declared a $0.40 per share cash dividend, date of record five days later.

Required

1. How many common shares are outstanding on each cash dividend date

2. What is the total dollar amount for each of the four cash dividends

3. What is the amount of the capitalization of retained earnings for the stock dividend

4. What is the per share cost of the treasury stock purchased

5. How much net income did the company earn during year 2016

The following transactions and events affected its equity during year 2016.

Feb. 15 Declared a $0.40 per share cash dividend, date of record five days later.

Mar. 2 Purchased treasury stock for cash.

May 15 Declared a $0.40 per share cash dividend, date of record five days later.

Aug. 15 Declared a $0.40 per share cash dividend, date of record five days later.

Oct. 4 Declared a 12.5% stock dividend when the stock's market value is $42 per share.

Oct. 20 Issued the stock dividend that was declared on October 4.

Nov. 15 Declared a $0.40 per share cash dividend, date of record five days later.

Required

1. How many common shares are outstanding on each cash dividend date

2. What is the total dollar amount for each of the four cash dividends

3. What is the amount of the capitalization of retained earnings for the stock dividend

4. What is the per share cost of the treasury stock purchased

5. How much net income did the company earn during year 2016

Explanation

1.

On the 15 th day of February, May, A...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255