Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 85

Braun Company signs a five-year capital lease with Verdi Company for office equipment. The annual year-end lease payment is $20,000, and the interest rate is 10%.

Required

1. Compute the present value of Braun's lease payments.

2. Prepare the journal entry to record Braun's capital lease at its inception.

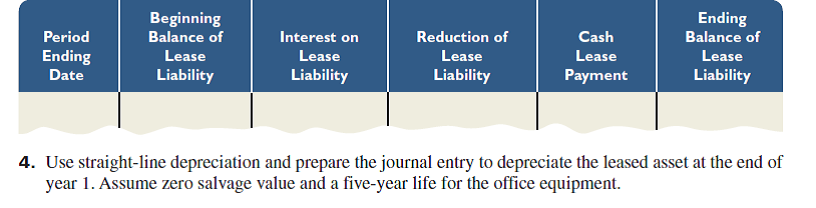

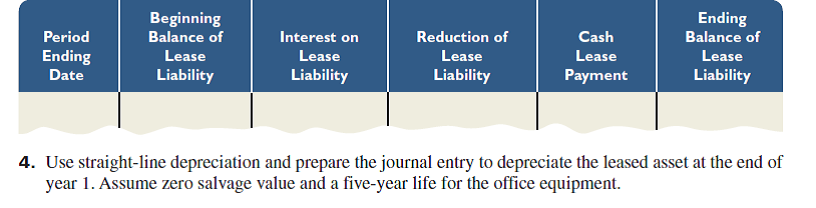

3. Complete a lease payment schedule for the five years of the lease with the following headings. Assume that the beginning balance of the lease liability (present value of lease payments) is $75,816. ( Hint: To find the amount allocated to interest in year 1, multiply the interest rate by the beginning-of-year lease liability. The amount of the annual lease payment not allocated to interest is allocated to principal. Reduce the lease liability by the amount allocated to principal to update the lease liability at each year-end.)

Required

1. Compute the present value of Braun's lease payments.

2. Prepare the journal entry to record Braun's capital lease at its inception.

3. Complete a lease payment schedule for the five years of the lease with the following headings. Assume that the beginning balance of the lease liability (present value of lease payments) is $75,816. ( Hint: To find the amount allocated to interest in year 1, multiply the interest rate by the beginning-of-year lease liability. The amount of the annual lease payment not allocated to interest is allocated to principal. Reduce the lease liability by the amount allocated to principal to update the lease liability at each year-end.)

Explanation

1.

Computation of present value of lease...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255