Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 42

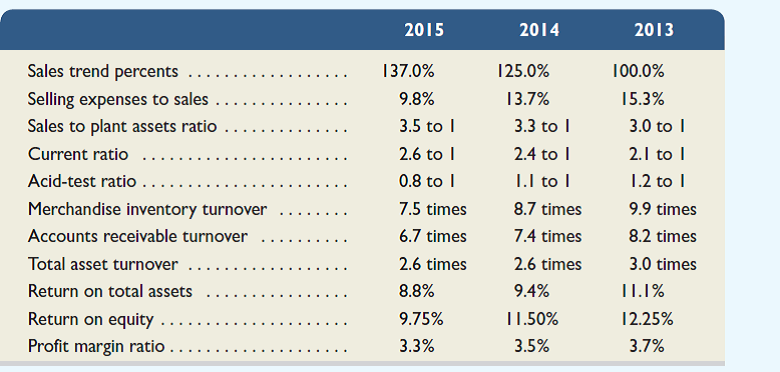

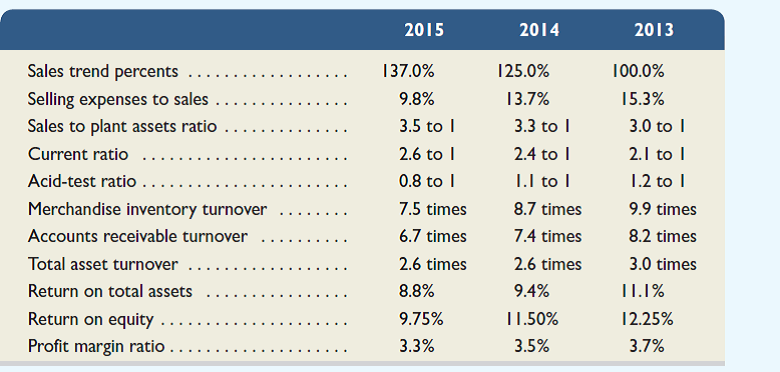

Assume that David and Tom Gardner of The Motley Fool ( Fool.com ) have impressed you since you first heard of their rather improbable rise to prominence in financial circles. You learn of a staff opening at The Motley Fool and decide to apply for it. Your resume is successfully screened from the thousands received and you advance to the interview process. You learn that the interview consists of analyzing the following financial facts and answering analysis questions below. (The data are taken from a small merchandiser in outdoor recreational equipment.)

Required

Use these data to answer each of the following questions with explanations.

1. Is it becoming easier for the company to meet its current liabilities on time and to take advantage of any available cash discounts Explain.

2. Is the company collecting its accounts receivable more rapidly Explain.

3. Is the company's investment in accounts receivable decreasing Explain.

4. Is the company's investment in plant assets increasing Explain.

5. Is the owner's investment becoming more profitable Explain.

6. Did the dollar amount of selling expenses decrease during the three-year period Explain.

Required

Use these data to answer each of the following questions with explanations.

1. Is it becoming easier for the company to meet its current liabilities on time and to take advantage of any available cash discounts Explain.

2. Is the company collecting its accounts receivable more rapidly Explain.

3. Is the company's investment in accounts receivable decreasing Explain.

4. Is the company's investment in plant assets increasing Explain.

5. Is the owner's investment becoming more profitable Explain.

6. Did the dollar amount of selling expenses decrease during the three-year period Explain.

Explanation

Financial ratios are significant indicat...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255