Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 20

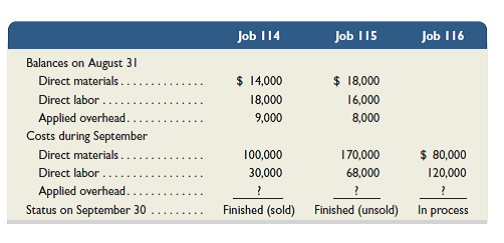

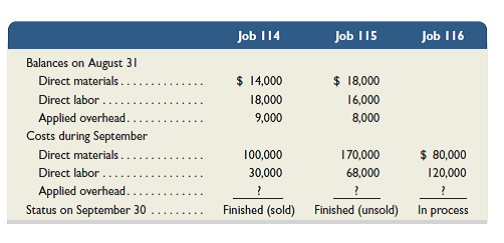

Perez Mfg.'s August 31 inventory of raw materials is $150,000. Raw materials purchases in September are $400,000, and factory payroll cost in September is $232,000. Overhead costs incurred in September are: indirect materials, $30,000; indirect labor, $14,000; factory rent, $20,000; factory utilities, $12,000; and factory equipment depreciation, $30,000. The predetermined overhead rate is 50% of direct labor cost. Job 114 is sold for $380,000 cash in September. Costs for the three jobs worked on in September follow.

Required

1. Determine the total of each production cost incurred for September (direct labor, direct materials, and applied overhead), and the total cost assigned to each job (including the balances from August 31).

2. Prepare journal entries for the month of September to record the following.

a. Materials purchases (on credit).

b. Direct materials used in production.

c. Direct labor paid and assigned to Work in Process Inventory.

d. Indirect labor paid and assigned to Factory Overhead.

e. Overhead costs applied to Work in Process Inventory.

f. Actual overhead costs incurred, including indirect materials. (Factory rent and utilities are paid in cash.)

g. Transfer of Jobs 114 and 115 to the Finished Goods Inventory.

h. Cost of Job 114 in the Cost of Goods Sold account.

i. Revenue from the sale of Job 114.

j. Assignment of any underapplied or overapplied overhead to the Cost of Goods Sold account. (The amount is not material.)

3. Prepare a schedule of cost of goods manufactured.

4. Compute gross profit for September. Show how to present the inventories on the September 30 balance sheet.

Analysis Component

5. The over- or underapplied overhead adjustment is closed to Cost of Goods Sold. Discuss how this adjustment impacts business decision making regarding individual jobs or batches of jobs.

Required

1. Determine the total of each production cost incurred for September (direct labor, direct materials, and applied overhead), and the total cost assigned to each job (including the balances from August 31).

2. Prepare journal entries for the month of September to record the following.

a. Materials purchases (on credit).

b. Direct materials used in production.

c. Direct labor paid and assigned to Work in Process Inventory.

d. Indirect labor paid and assigned to Factory Overhead.

e. Overhead costs applied to Work in Process Inventory.

f. Actual overhead costs incurred, including indirect materials. (Factory rent and utilities are paid in cash.)

g. Transfer of Jobs 114 and 115 to the Finished Goods Inventory.

h. Cost of Job 114 in the Cost of Goods Sold account.

i. Revenue from the sale of Job 114.

j. Assignment of any underapplied or overapplied overhead to the Cost of Goods Sold account. (The amount is not material.)

3. Prepare a schedule of cost of goods manufactured.

4. Compute gross profit for September. Show how to present the inventories on the September 30 balance sheet.

Analysis Component

5. The over- or underapplied overhead adjustment is closed to Cost of Goods Sold. Discuss how this adjustment impacts business decision making regarding individual jobs or batches of jobs.

Explanation

1.

In this case, it has to be noted that...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255