Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 29

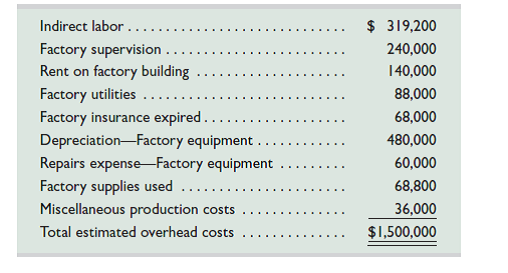

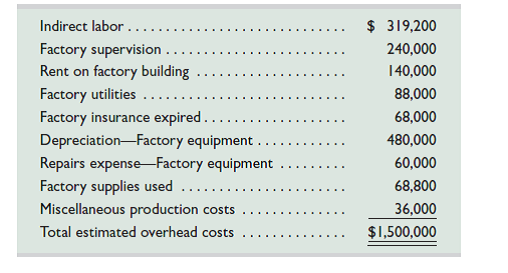

In December 2014, Learer Company's manager estimated next year's total direct labor cost assuming 50 persons working an average of 2,000 hours each at an average wage rate of $25 per hour. The manager also estimated the following manufacturing overhead costs for 2015.

At the end of 2015, records show the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, $604,000; Job 202, $563,000; Job 203, $298,000; Job 204, $716,000; and Job 205, $314,000. In addition, Job 206 is in process at the end of 2015 and had been charged $17,000 for direct labor. No jobs were in process at the end of 2014. The company's predetermined overhead rate is based on direct labor cost.

Required

1. Determine the following.

a. Predetermined overhead rate for 2015.

b. Total overhead cost applied to each of the six jobs during 2015.

c. Over- or underapplied overhead at year-end 2015.

2. Assuming that any over- or underapplied overhead is not material, prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold at the end of 2015.

At the end of 2015, records show the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, $604,000; Job 202, $563,000; Job 203, $298,000; Job 204, $716,000; and Job 205, $314,000. In addition, Job 206 is in process at the end of 2015 and had been charged $17,000 for direct labor. No jobs were in process at the end of 2014. The company's predetermined overhead rate is based on direct labor cost.

Required

1. Determine the following.

a. Predetermined overhead rate for 2015.

b. Total overhead cost applied to each of the six jobs during 2015.

c. Over- or underapplied overhead at year-end 2015.

2. Assuming that any over- or underapplied overhead is not material, prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold at the end of 2015.

Explanation

1.

a.

In this case, overhead rate refers...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255