Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 86

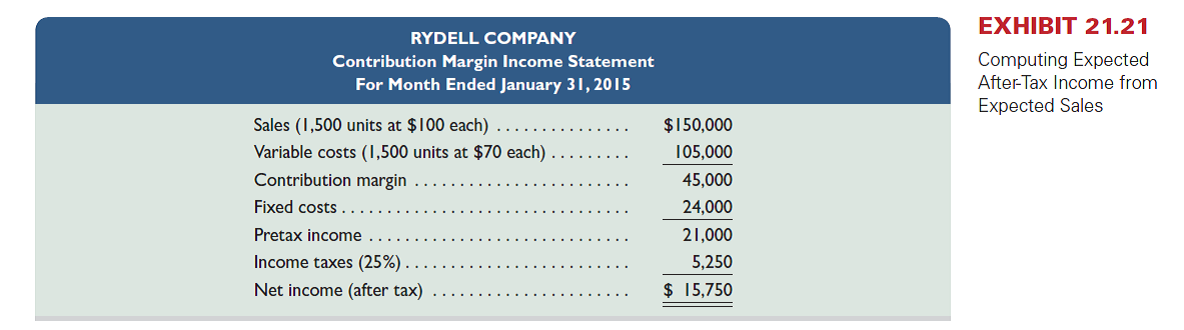

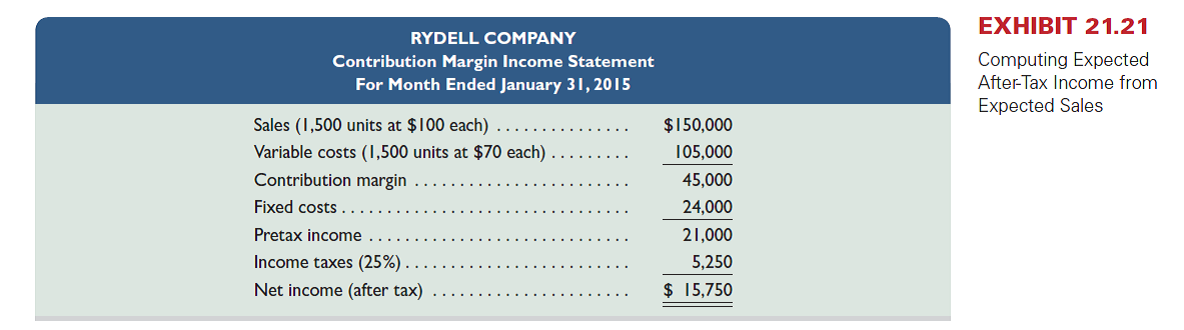

Blanchard Company manufactures a single product that sells for $180 per unit and whose total variable costs are $135 per unit. The company's annual fixed costs are $562,500. The sales manager predicts that annual sales of the company's product will soon reach 40,000 units and its price will increase to $200 per unit. According to the production manager, the variable costs are expected to increase to $140 per unit but fixed costs will remain at $562,500. The income tax rate is 20%. What amounts of pretax and after-tax income can the company expect to earn from these predicted changes ( Hint: Prepare a forecasted contribution margin income statement as in Exhibit 21.21.)

REFERENCE: Exhibit 21.21

REFERENCE: Exhibit 21.21

Explanation

Calculate forecasted net income:

Follow...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255