Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 2

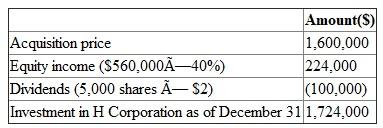

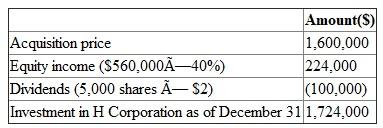

On January 1, Puckett Company paid $1.6 million for 50,000 shares of Harrison's voting common stock, which represents a 40 percent investment.No allocation to goodwill or other specific account was made.Significant influence over Harrison is achieved by this acquisition and so Puckett applies the equity method.Harrison distributed a dividend of $2 per share during the year and reported net income of $560,000.What is the balance in the Investment in Harrison account found in Puckett's financial records as of December 31 a.$1,724,000.

B)$1,784,000.

C)$1,844,000.

D)$1,884,000.

B)$1,784,000.

C)$1,844,000.

D)$1,884,000.

Explanation

The investment in H Corporation as of December 31:  The investment in H Corporation as of December 31 is $1,724,000.

The investment in H Corporation as of December 31 is $1,724,000.

Hence, the option ( A ) is correct.

The investment in H Corporation as of December 31 is $1,724,000.

The investment in H Corporation as of December 31 is $1,724,000.Hence, the option ( A ) is correct.

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255