Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 46

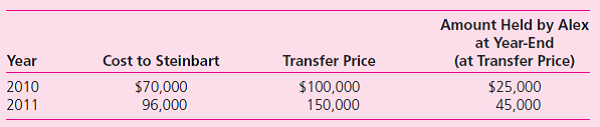

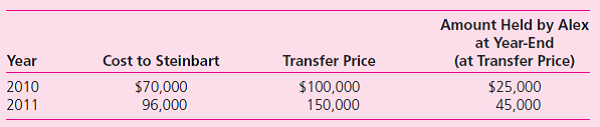

Alex, Inc., buys 40 percent of Steinbart Company on January 1, 2010, for $530,000.The equity method of accounting is to be used.Steinbart's net assets on that date were $1.2 million.Any excess of cost over book value is attributable to a trade name with a 20-year remaining life.Steinbart immediately begins supplying inventory to Alex as follows:  Inventory held at the end of one year by Alex is sold at the beginning of the next.Steinbart reports net income of $80,000 in 2010 and $110,000 in 2011 while paying $30,000 in dividends each year.What is the equity income in Steinbart to be reported by Alex in 2011

Inventory held at the end of one year by Alex is sold at the beginning of the next.Steinbart reports net income of $80,000 in 2010 and $110,000 in 2011 while paying $30,000 in dividends each year.What is the equity income in Steinbart to be reported by Alex in 2011

A)$34,050.

B)$38,020.

C)$46,230.

D)$51,450.

Inventory held at the end of one year by Alex is sold at the beginning of the next.Steinbart reports net income of $80,000 in 2010 and $110,000 in 2011 while paying $30,000 in dividends each year.What is the equity income in Steinbart to be reported by Alex in 2011

Inventory held at the end of one year by Alex is sold at the beginning of the next.Steinbart reports net income of $80,000 in 2010 and $110,000 in 2011 while paying $30,000 in dividends each year.What is the equity income in Steinbart to be reported by Alex in 2011A)$34,050.

B)$38,020.

C)$46,230.

D)$51,450.

Explanation

Calculate excess purchase price attribut...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255