Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 32

On January 1, 2009, Monroe, Inc., purchased 10,000 shares of Brown Company for $250,000, giving Monroe 10 percent ownership of Brown.On January 1, 2010, Monroe purchased an additional 20,000 shares (20 percent) for $590,000.This latest purchase gave Monroe the ability to apply significant influence over Brown.The original 10 percent investment was categorized as an available-for sale security.Any excess of cost over book value acquired for either investment was attributed solely to goodwill.

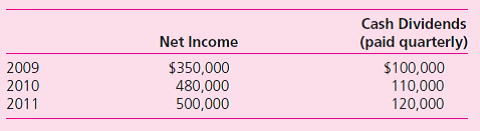

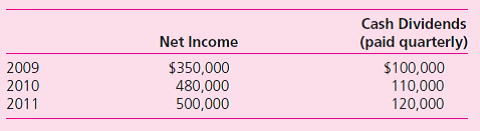

Brown reports net income and dividends as follows.These amounts are assumed to have occurred evenly throughout these years.

On July 1, 2011, Monroe sells 2,000 shares of this investment for $46 per share, thus reducing its interest from 30 to 28 percent.However, the company retains the ability to significantly influence Brown.Using the equity method, what amounts appear in Monroe's 2011 income statement

Brown reports net income and dividends as follows.These amounts are assumed to have occurred evenly throughout these years.

On July 1, 2011, Monroe sells 2,000 shares of this investment for $46 per share, thus reducing its interest from 30 to 28 percent.However, the company retains the ability to significantly influence Brown.Using the equity method, what amounts appear in Monroe's 2011 income statement

Explanation

Dividends:

It refers to the payment mad...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255