Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 62

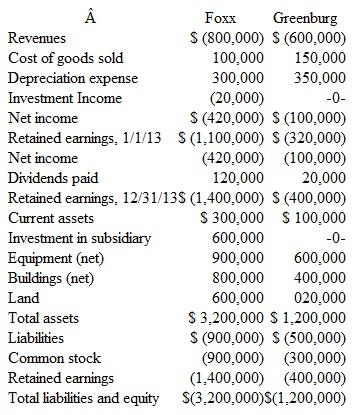

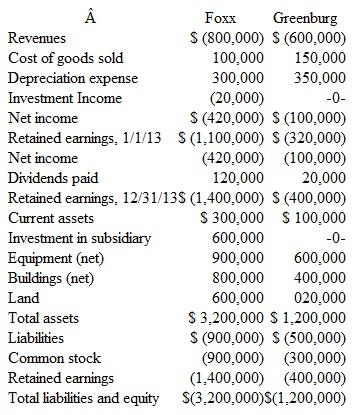

Foxx Corporation acquired all of Greenburg Company's outstanding stockon January 1,2011, for $600,000 cash.Greenburg's accounting records showed net assetson that date of$470,000,although equipment with a 10-year life was undervalued on the recordsby $90,000.Any recognized goodwill is considered to have an indefinite life.

Greenburg reports net income in 2011 of $90,000 and $100,000in 2012.The subsidiary paid dividends of $20,000 in each of these two years.Financial figures for the year ending December 31,2013, follow.Credit balances are indicated by parentheses. a. Determine the December 31,2013, consolidated balance for each of the following accounts:

a. Determine the December 31,2013, consolidated balance for each of the following accounts:  b. How does the parent's choice of an accounting method for its investment affect the balances computed in requirement ( a )

b. How does the parent's choice of an accounting method for its investment affect the balances computed in requirement ( a )

c. Which method of accounting for this subsidiary is the parent actually using for internal reporting purposes

d. If the parent company had used a different method of accounting for this investment, how could that method have been identified

e. What would be Foxx's balance for retained earnings as of January 1, 2013, if each of the following methods had been in use

Initial value method

Partial equity method

Equity method

Greenburg reports net income in 2011 of $90,000 and $100,000in 2012.The subsidiary paid dividends of $20,000 in each of these two years.Financial figures for the year ending December 31,2013, follow.Credit balances are indicated by parentheses.

a. Determine the December 31,2013, consolidated balance for each of the following accounts:

a. Determine the December 31,2013, consolidated balance for each of the following accounts:  b. How does the parent's choice of an accounting method for its investment affect the balances computed in requirement ( a )

b. How does the parent's choice of an accounting method for its investment affect the balances computed in requirement ( a ) c. Which method of accounting for this subsidiary is the parent actually using for internal reporting purposes

d. If the parent company had used a different method of accounting for this investment, how could that method have been identified

e. What would be Foxx's balance for retained earnings as of January 1, 2013, if each of the following methods had been in use

Initial value method

Partial equity method

Equity method

Explanation

This problem requires knowledge of conso...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255