Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 16

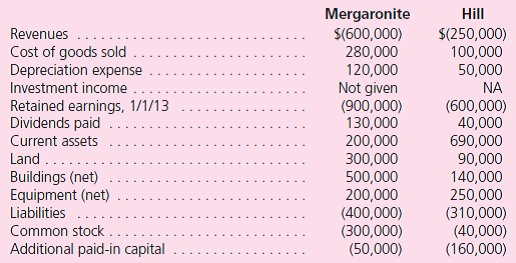

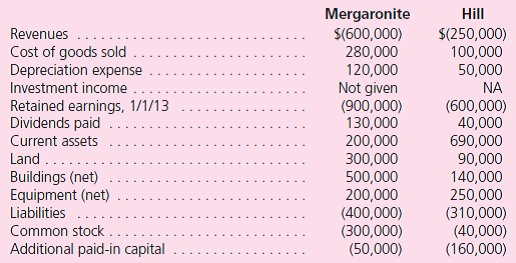

Following are selected accounts for Mergaronite Company and Hill, Inc., as of December 31, 2013.Several of Mergaronite's accounts have been omitted.Credit balances are indicated by parentheses.

Assume that Mergaronite took over Hill on January 1, 2009, by issuing 7,000 shares of common stock having a par value of $10 per share but a fair value of $100 each.On January 1, 2009, Hill's land was undervalued by $20,000, its buildings were overvalued by $30,000, and equipment was undervalued by $60,000.The buildings had a 10-year life; the equipment had a 5-year life.A customer list with an appraised value of $100,000 was developed internally by Hill and was to be written off over a 20-year period.

a.Determine and explain the December 31, 2013, consolidated totals for the following accounts:

Revenues Amortization Expense Customer List

Cost of Goods Sold Buildings Common Stock

Depreciation Expense Equipment Additional Paid-In Capital

b.In requirement ( a ), why can the consolidated totals be determined without knowing which method the parent used to account for the subsidiary

c.If the parent uses the equity method, what consolidation entries would be used on a 2013 worksheet

Assume that Mergaronite took over Hill on January 1, 2009, by issuing 7,000 shares of common stock having a par value of $10 per share but a fair value of $100 each.On January 1, 2009, Hill's land was undervalued by $20,000, its buildings were overvalued by $30,000, and equipment was undervalued by $60,000.The buildings had a 10-year life; the equipment had a 5-year life.A customer list with an appraised value of $100,000 was developed internally by Hill and was to be written off over a 20-year period.

a.Determine and explain the December 31, 2013, consolidated totals for the following accounts:

Revenues Amortization Expense Customer List

Cost of Goods Sold Buildings Common Stock

Depreciation Expense Equipment Additional Paid-In Capital

b.In requirement ( a ), why can the consolidated totals be determined without knowing which method the parent used to account for the subsidiary

c.If the parent uses the equity method, what consolidation entries would be used on a 2013 worksheet

Explanation

Consolidated totals for the different ac...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255