Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 24

Note: Problems 1 through 37 assume the use of the acquisition method.Problems 38 through 40 assume the use of the purchase method.

On July 1, 2011, Truman Company acquired a 70 percent interest in Atlanta Company in exchange for consideration of $720,000 in cash and equity securities.The remaining 30 percent of Atlanta's shares traded closely near an average price that totaled $290,000 both before and after Truman's acquisition.

In reviewing its acquisition, Truman assigned a $100,000 fair value to a patent recently developed by Atlanta, even though it was not recorded within the financial records of the subsidiary.This patent is anticipated to have a remaining life of five years.

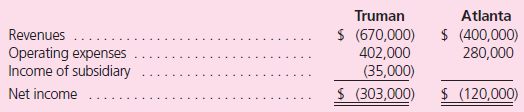

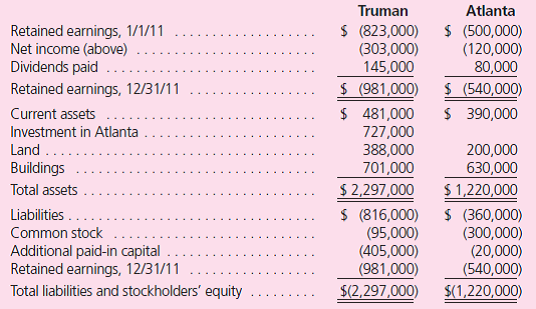

The following financial information is available for these two companies for 2011.In addition, the subsidiary's income was earned uniformly throughout the year.Subsidiary dividend payments were made quarterly.

Answer each of the following:

a.How did Truman allocate Atlanta's acquisition-date fair value to the various assets acquired and liabilities assumed in the combination

b.How did Truman allocate the goodwill from the acquisition across the controlling and noncontrolling interests

c.How did Truman derive the Investment in Atlanta account balance at the end of 2011

d.Prepare a worksheet to consolidate the financial statements of these two companies as of December 31, 2011.

On July 1, 2011, Truman Company acquired a 70 percent interest in Atlanta Company in exchange for consideration of $720,000 in cash and equity securities.The remaining 30 percent of Atlanta's shares traded closely near an average price that totaled $290,000 both before and after Truman's acquisition.

In reviewing its acquisition, Truman assigned a $100,000 fair value to a patent recently developed by Atlanta, even though it was not recorded within the financial records of the subsidiary.This patent is anticipated to have a remaining life of five years.

The following financial information is available for these two companies for 2011.In addition, the subsidiary's income was earned uniformly throughout the year.Subsidiary dividend payments were made quarterly.

Answer each of the following:

a.How did Truman allocate Atlanta's acquisition-date fair value to the various assets acquired and liabilities assumed in the combination

b.How did Truman allocate the goodwill from the acquisition across the controlling and noncontrolling interests

c.How did Truman derive the Investment in Atlanta account balance at the end of 2011

d.Prepare a worksheet to consolidate the financial statements of these two companies as of December 31, 2011.

Explanation

Consolidated balance sheet:

The consoli...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255