Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 41

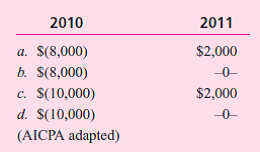

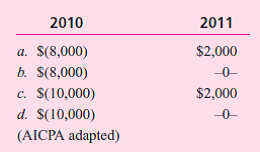

Dunn Corporation owns 100 percent of Grey Corporation's common stock.On January 2, 2010, Dunn sold to Grey for $40,000 machinery with a carrying amount of $30,000.Grey is depreciating the acquired machinery over a five-year life by the straight-line method.The net adjustments to compute 2010 and 2011 consolidated net income would be an increase (decrease) of

Explanation

Step 1:

Calculate unrealized gain on sal...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255