Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 33

On January 1, 2010, Woods, Inc., acquired a 60 percent interest in the common stock of Scott, Inc., for $672,000.Scott's book value on that date consisted of common stock of $100,000 and retained earnings of $220,000.Also, the Junuary 1, 2010, fair value on the 40 percent noncontrolling interest was $248,000.The subsidiary held patents (with a 10-year remaining life) that were undervalued within the company's accounting records by $70,000 and an unrecorded customer list (15-year remaining life) assessed at a $45,000 fair value.Any remaining excess acquisition-date fair value was assigned to goodwill.Since acquisition, Woods has applied the equity method to its Investment in Scott account and no goodwill impairment has occurred.

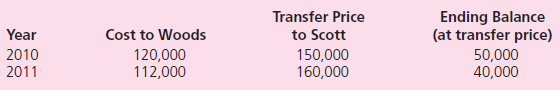

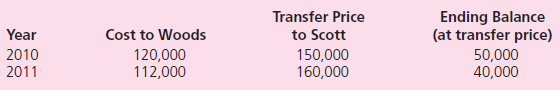

Intra-entity inventory sales between the two companies have been made as follows:

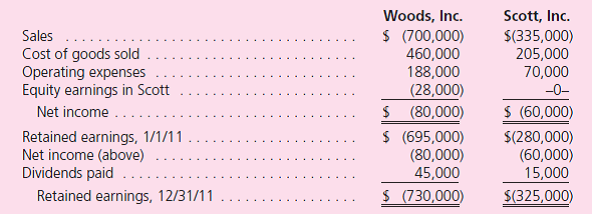

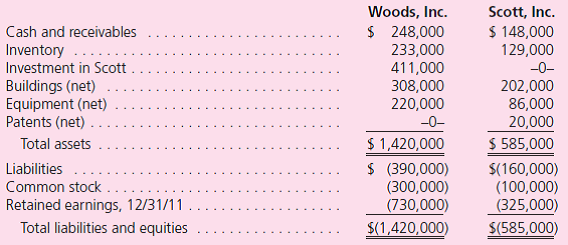

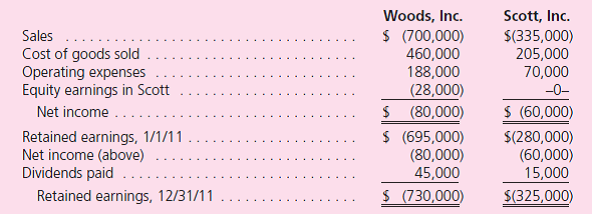

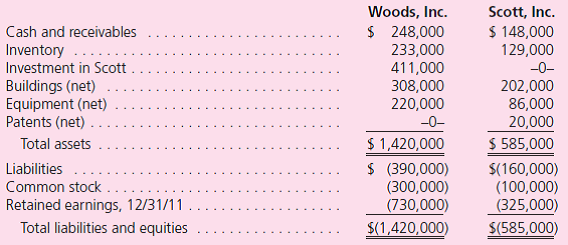

The individual financial statements for these two companies as of December 31, 2011, and the year then ended follow:

a.Show how Woods determined the $411,000 Investment in Scott account balance.Assume that Woods defers 100 percent of downstream intra-entity profits against its share of Scott's income.

b.Prepare a consolidated worksheet to determine appropriate balances for external financial reporting as of December 31, 2011.

Intra-entity inventory sales between the two companies have been made as follows:

The individual financial statements for these two companies as of December 31, 2011, and the year then ended follow:

a.Show how Woods determined the $411,000 Investment in Scott account balance.Assume that Woods defers 100 percent of downstream intra-entity profits against its share of Scott's income.

b.Prepare a consolidated worksheet to determine appropriate balances for external financial reporting as of December 31, 2011.

Explanation

Consolidated work paper

A document that...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255