Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 36

On January 1, 2009, Plymouth Corporation acquired 80 percent of the outstanding voting stock of Sander Company in exchange for $1,200,000 cash.At that time, although Sander's book value was $925,000, Plymouth assessed Sander's total business fair value at $1,500,000.Since that time, Sander has neither issued nor reacquired any shares of its own stock.

The book values of Sander's individual assets and liabilities approximated their acquisition-date fair values except for the patent account, which was undervalued by $350,000.The undervalued patents had a 5-year remaining life at the acquisition date.Any remaining excess fair value was attributed to goodwill.No goodwill impairments have occurred.

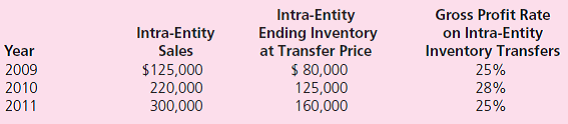

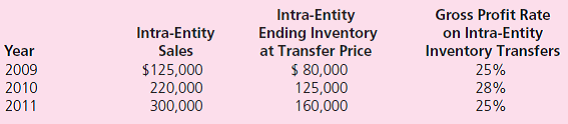

Sander regularly sells inventory to Plymouth.Below are details of the intra-entity inventory sales for the past three years:

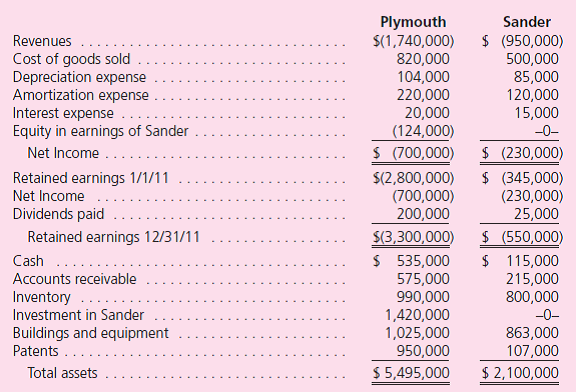

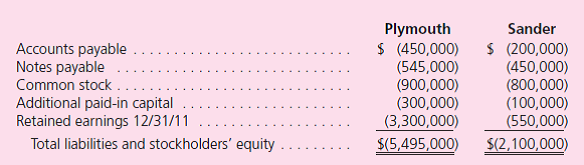

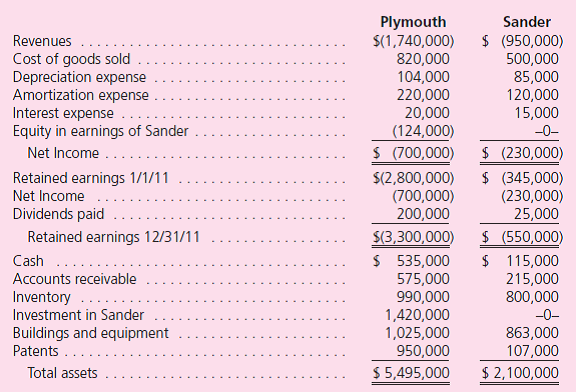

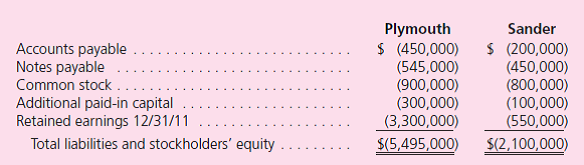

Separate financial statements for these two companies as of December 31, 2011, follow:

a.Prepare a schedule that calculates the Equity in Earnings of Sander account balance.

b.Prepare a worksheet to arrive at consolidated figures for external reporting purposes.

The book values of Sander's individual assets and liabilities approximated their acquisition-date fair values except for the patent account, which was undervalued by $350,000.The undervalued patents had a 5-year remaining life at the acquisition date.Any remaining excess fair value was attributed to goodwill.No goodwill impairments have occurred.

Sander regularly sells inventory to Plymouth.Below are details of the intra-entity inventory sales for the past three years:

Separate financial statements for these two companies as of December 31, 2011, follow:

a.Prepare a schedule that calculates the Equity in Earnings of Sander account balance.

b.Prepare a worksheet to arrive at consolidated figures for external reporting purposes.

Explanation

Consolidated work paper

A document that...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255