Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 18

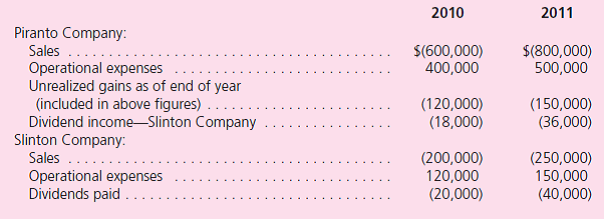

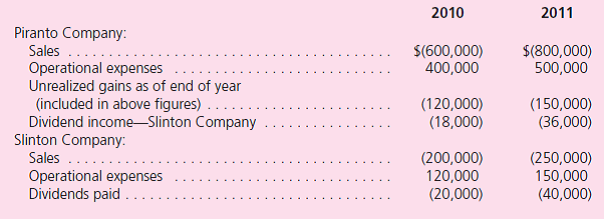

On January 1, 2010, Piranto acquires 90 percent of Slinton's outstanding shares.Financial information for these two companies for the years of 2010 and 2011 follows:

Assume that a tax rate of 40 percent is applicable to both companies.

a.On consolidated financial statements for 2011, what are the income tax expense and the income tax currently payable if Piranto and Slinton file a consolidated tax return as an affiliated group

b.On consolidated financial statements for 2011, what are the income tax expense and income tax currently payable for each company if they choose to file separate returns

Assume that a tax rate of 40 percent is applicable to both companies.

a.On consolidated financial statements for 2011, what are the income tax expense and the income tax currently payable if Piranto and Slinton file a consolidated tax return as an affiliated group

b.On consolidated financial statements for 2011, what are the income tax expense and income tax currently payable for each company if they choose to file separate returns

Explanation

Consolidated balance sheet:

The consoli...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255