Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 36

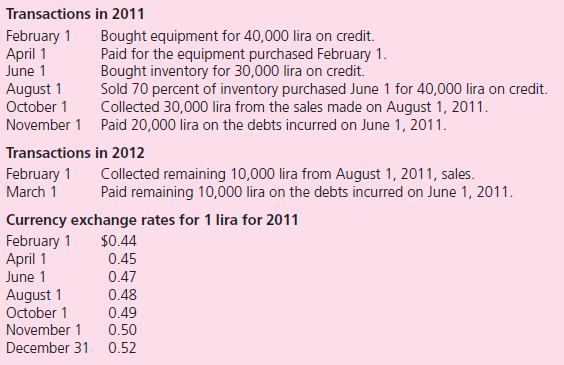

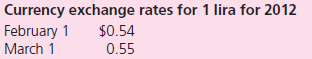

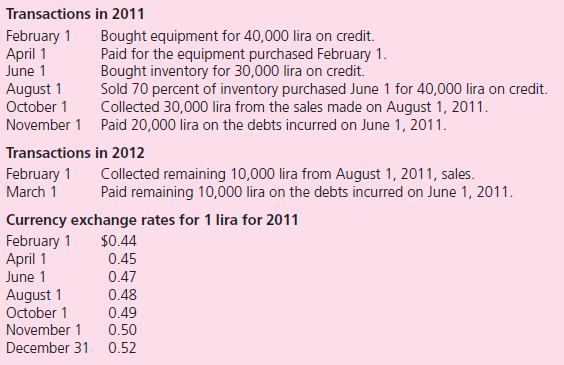

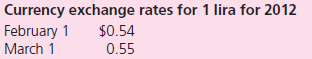

Bartlett Company, headquartered in Cincinnati, Ohio, has occasional transactions with companies in a foreign country whose currency is the lira.Prepare journal entries for the following transactions in U.S.dollars.Also prepare any necessary adjusting entries at December 31 caused by fluctuations in the value of the lira.Assume that the company uses a perpetual inventory system.

Explanation

Foreign currency transaction:

It refers...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255