Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 21

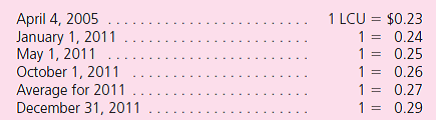

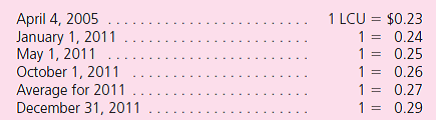

Aerkion Company starts 2011 with two assets: cash of 22,000 LCU (local currency units) and land that originally cost 60,000 LCU when acquired on April 4, 2005.On May 1, 2011, Aerkion rendered services to a customer for 30,000 LCU, an amount immediately paid in cash.On October 1, 2011, the company incurred an 18,000 LCU operating expense that was immediately paid.No other transactions occurred during the year.Currency exchange rates for 1 LCU follow:

a.Assume that Aerkion is a foreign subsidiary of a U.S.multinational company that uses the U.S.dollar as its reporting currency.Assume also that the LCU is the subsidiary's functional currency.What is the translation adjustment for this subsidiary for the year 2011

b.Assume that Aerkion is a foreign subsidiary of a U.S.multinational company that uses the U.S.dollar as its reporting currency.Assume also that the U.S.dollar is the subsidiary's functional currency.What is the remeasurement gain or loss for 2011

c.Assume that Aerkion is a foreign subsidiary of a U.S.multinational company.On the December 31, 2011, balance sheet, what is the translated value of the Land account On the December 31, 2011, balance sheet, what is the remeasured value of the Land account

a.Assume that Aerkion is a foreign subsidiary of a U.S.multinational company that uses the U.S.dollar as its reporting currency.Assume also that the LCU is the subsidiary's functional currency.What is the translation adjustment for this subsidiary for the year 2011

b.Assume that Aerkion is a foreign subsidiary of a U.S.multinational company that uses the U.S.dollar as its reporting currency.Assume also that the U.S.dollar is the subsidiary's functional currency.What is the remeasurement gain or loss for 2011

c.Assume that Aerkion is a foreign subsidiary of a U.S.multinational company.On the December 31, 2011, balance sheet, what is the translated value of the Land account On the December 31, 2011, balance sheet, what is the remeasured value of the Land account

Explanation

Translation adjustment:

The translation...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255