Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 15

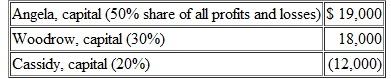

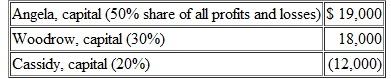

A local partnership is liquidating and is currently reporting the following capital balances:  Cassidy has indicated that a forthcoming contribution will cover the $12,000 deficit.However, the two remaining partners have asked to receive the $25,000 in cash that is presently available.How much of this money should each of the partners be given

Cassidy has indicated that a forthcoming contribution will cover the $12,000 deficit.However, the two remaining partners have asked to receive the $25,000 in cash that is presently available.How much of this money should each of the partners be given

a.Angela, $ 13,000; Woodrow, $ 12,000.

b.Angela, $11,500; Woodrow, $13,500.

c.Angela, $ 12,000; Woodrow, $ 13,000.

d.Angela, $12,500; Woodrow, $12,500.

Cassidy has indicated that a forthcoming contribution will cover the $12,000 deficit.However, the two remaining partners have asked to receive the $25,000 in cash that is presently available.How much of this money should each of the partners be given

Cassidy has indicated that a forthcoming contribution will cover the $12,000 deficit.However, the two remaining partners have asked to receive the $25,000 in cash that is presently available.How much of this money should each of the partners be given a.Angela, $ 13,000; Woodrow, $ 12,000.

b.Angela, $11,500; Woodrow, $13,500.

c.Angela, $ 12,000; Woodrow, $ 13,000.

d.Angela, $12,500; Woodrow, $12,500.

Explanation

Each partner will be given money as foll...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255