Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 6

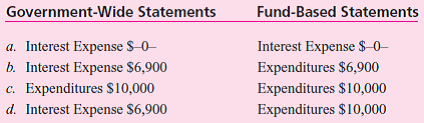

A city government has a nine-year capital lease for property being used within the General Fund.The lease was signed on January 1, 2010.Minimum lease payments total $90,000 starting at the end of the first year but have a current present value of $69,000.Annual payments are $10,000, and the interest rate being applied is 10 percent.When the first payment is made on December 31, 2010, which of the following recordings is made

Explanation

The following entry will be made at the ...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255