Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 74

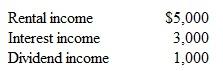

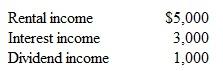

An estate has the following income:  The interest income was immediately conveyed to the appropriate beneficiary.The dividends were given to charity as per the decedent's will.What is the taxable income of the estate

The interest income was immediately conveyed to the appropriate beneficiary.The dividends were given to charity as per the decedent's will.What is the taxable income of the estate

a.$4,400.

b.$5,000.

c.$8,000.

d.$8,400.

The interest income was immediately conveyed to the appropriate beneficiary.The dividends were given to charity as per the decedent's will.What is the taxable income of the estate

The interest income was immediately conveyed to the appropriate beneficiary.The dividends were given to charity as per the decedent's will.What is the taxable income of the estate a.$4,400.

b.$5,000.

c.$8,000.

d.$8,400.

Explanation

Finding the correct option among the fou...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255