Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 35

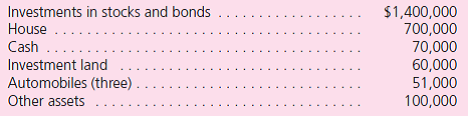

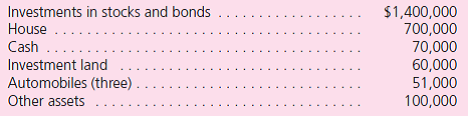

Donna Stober's estate has the following assets (all figures approximate fair value):

The house, cash, and other assets are left to the decedent's spouse.The investment land is contributed to a charitable organization.The automobiles are to be given to the decedent's brother.The investments in stocks and bonds are to be put into a trust fund.The income generated by this trust will go to the decedent's spouse annually until all of the couple's children have reached the age of 25.At that time, the trust will be divided evenly among the children.

The following amounts are paid prior to distribution and settlement of the estate: funeral expenses of $20,000 and estate administration expenses of $10,000.

a.What value is to be reported as the taxable estate for federal estate tax purposes

b.How does the year in which an individual dies affect the estate tax computation For example, what is the impact of dying on December 30, 2008, versus January 2, 2009, or December 30, 2009, versus January 2, 2010

The house, cash, and other assets are left to the decedent's spouse.The investment land is contributed to a charitable organization.The automobiles are to be given to the decedent's brother.The investments in stocks and bonds are to be put into a trust fund.The income generated by this trust will go to the decedent's spouse annually until all of the couple's children have reached the age of 25.At that time, the trust will be divided evenly among the children.

The following amounts are paid prior to distribution and settlement of the estate: funeral expenses of $20,000 and estate administration expenses of $10,000.

a.What value is to be reported as the taxable estate for federal estate tax purposes

b.How does the year in which an individual dies affect the estate tax computation For example, what is the impact of dying on December 30, 2008, versus January 2, 2009, or December 30, 2009, versus January 2, 2010

Explanation

Income tax:

The income tax is referred ...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255