Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 7ISBN: 978-0077733773

Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 7ISBN: 978-0077733773 Exercise 14

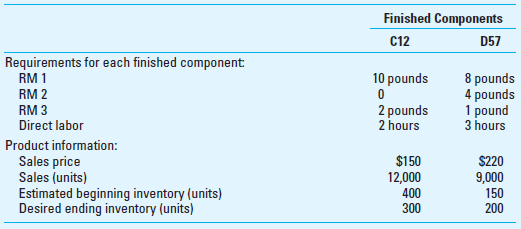

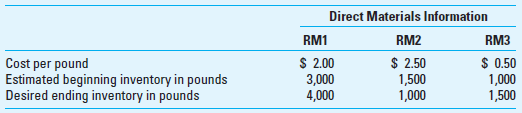

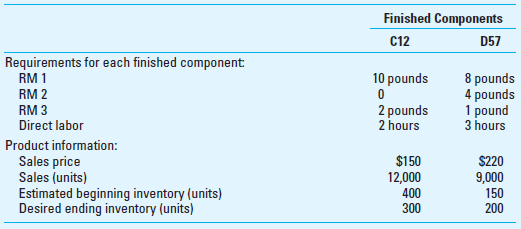

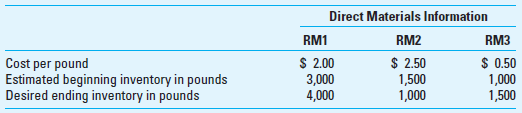

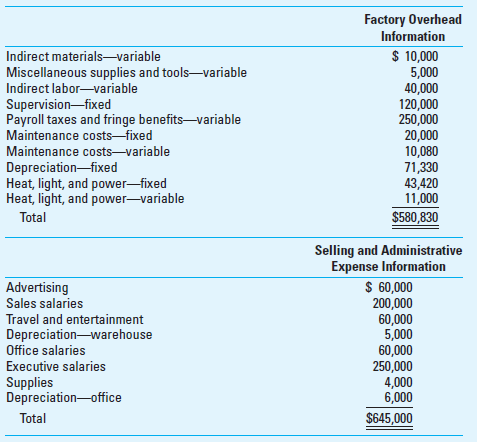

Comprehensive Profit Plan Spring Manufacturing Company makes two components identified as C12 and D57. Selected budgetary data for 2016 follow:

The firm expects the average wage rate to be $25 per hour in 2016. Spring Manufacturing uses direct labor hours to apply overhead. Each year the firm determines the overhead application rate for the year based on the budgeted output for the year. The firm maintains negligible work-in-process inventory and expects the cost per unit for both beginning and ending finished products inventories to be identical.

The effective income tax rate for the company is 40%.

Required Prepare an Excel spreadsheet that contains the following schedules or statements for 2016:

1. Sales budget

2. Production budget

3. Direct materials purchases budget (units and dollars)

4. Direct labor budget

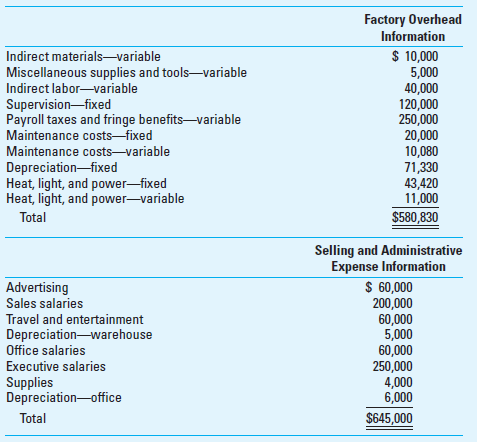

5. Factory overhead budget

6. Cost of goods sold and ending finished goods inventory budgets

7. Selling and administrative expense budget

8. Budgeted income statement

The firm expects the average wage rate to be $25 per hour in 2016. Spring Manufacturing uses direct labor hours to apply overhead. Each year the firm determines the overhead application rate for the year based on the budgeted output for the year. The firm maintains negligible work-in-process inventory and expects the cost per unit for both beginning and ending finished products inventories to be identical.

The effective income tax rate for the company is 40%.

Required Prepare an Excel spreadsheet that contains the following schedules or statements for 2016:

1. Sales budget

2. Production budget

3. Direct materials purchases budget (units and dollars)

4. Direct labor budget

5. Factory overhead budget

6. Cost of goods sold and ending finished goods inventory budgets

7. Selling and administrative expense budget

8. Budgeted income statement

Explanation

Budgeting:

Budgeting refers to a proces...

Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255