Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 7ISBN: 978-0077733773

Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 7ISBN: 978-0077733773 Exercise 26

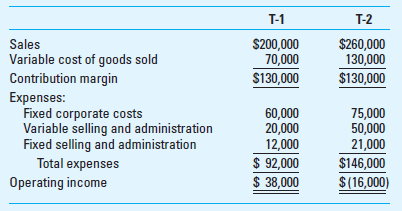

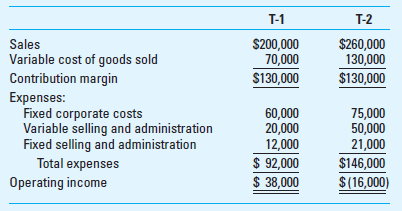

Product-Line Profitability Analysis Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known for its excellent quality and innovation. Recently the firm conducted a relevant cost analysis of one of its product lines that has only two products, T-1 and T-2. The sales for T-2 are decreasing and the purchase costs are increasing. The firm might drop T-2 and sell only T-1.

Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statement, he agreed that T-2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10% next year, but the firm's cost structure will remain the same.

Required

1. Find the expected change in annual operating income by dropping T-2 and selling only T-1.

2. By what percentage would sales from T-1 have to increase in order to make up the financial loss from dropping T-2

3. What is the required percentage increase in sales from T-1 to compensate for lost margin from T-2, if total fixed costs can be reduced by $45,000

4. What strategic factors should be considered

Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statement, he agreed that T-2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10% next year, but the firm's cost structure will remain the same.

Required

1. Find the expected change in annual operating income by dropping T-2 and selling only T-1.

2. By what percentage would sales from T-1 have to increase in order to make up the financial loss from dropping T-2

3. What is the required percentage increase in sales from T-1 to compensate for lost margin from T-2, if total fixed costs can be reduced by $45,000

4. What strategic factors should be considered

Explanation

Answer Sub Part (1)

The annual income w...

Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255