Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 7ISBN: 978-0077733773

Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 7ISBN: 978-0077733773 Exercise 44

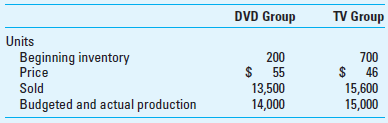

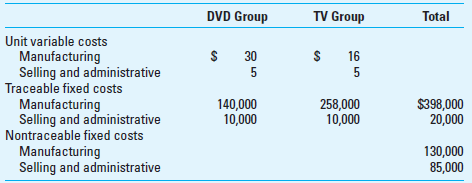

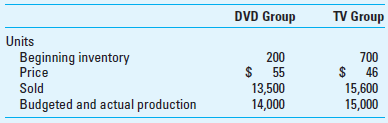

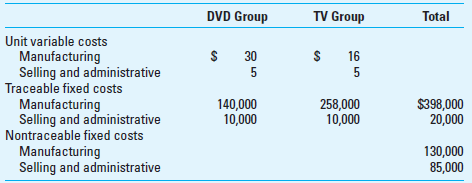

Value Streams and Profit Centers Levine Company is a manufacturer of very inexpensive DVD players and television sets. The company uses recycled parts and a highly structured manufacturing process to keep costs low so that it can sell at very low prices. The company uses lean accounting procedures to help keep costs low and to examine financial performance. Levine uses value streams to study the profitability of its two main product groups, DVD players and TVs. Information about finished goods inventory, sales, production, and average sales price follows.

Levine's costs for the current quarter are as follows. Note that some of the company's manufacturing and selling costs are traceable directly to the two value streams, while other costs are not traceable. Levine considers all traceable fixed costs to be controllable by the manager of each group. Also, Levine's value stream shows operating income determined by the full cost method; the difference from the traditional full cost income statement is that the effect on income from a change in inventory is shown as a separate item on the value-stream income statement.

Required

1. Consider Levine's two value streams as profit centers and use the contribution income statement as a guide to develop a value-stream income statement for the company. (See Exhibit 18.9 for an example of a contribution income statement.) In your solution, replace the term controllable margin (in Exhibit 18.9) with value-stream profit. Be sure to include the inventory effect on profit as a separate line item in your value-stream income statement.

2. Interpret the findings of the analysis you completed in requirement 1.

3. What is the benefit of the use of value streams for evaluating profit centers relative to the use of the contribution income statement for individual product lines

EXHIBIT 18.9 Machine Tools Inc. Contribution Income Statement (000s omitted)

Levine's costs for the current quarter are as follows. Note that some of the company's manufacturing and selling costs are traceable directly to the two value streams, while other costs are not traceable. Levine considers all traceable fixed costs to be controllable by the manager of each group. Also, Levine's value stream shows operating income determined by the full cost method; the difference from the traditional full cost income statement is that the effect on income from a change in inventory is shown as a separate item on the value-stream income statement.

Required

1. Consider Levine's two value streams as profit centers and use the contribution income statement as a guide to develop a value-stream income statement for the company. (See Exhibit 18.9 for an example of a contribution income statement.) In your solution, replace the term controllable margin (in Exhibit 18.9) with value-stream profit. Be sure to include the inventory effect on profit as a separate line item in your value-stream income statement.

2. Interpret the findings of the analysis you completed in requirement 1.

3. What is the benefit of the use of value streams for evaluating profit centers relative to the use of the contribution income statement for individual product lines

EXHIBIT 18.9 Machine Tools Inc. Contribution Income Statement (000s omitted)

Explanation

1) Here we are provided with the financi...

Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255