Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 7ISBN: 978-0077733773

Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 7ISBN: 978-0077733773 Exercise 30

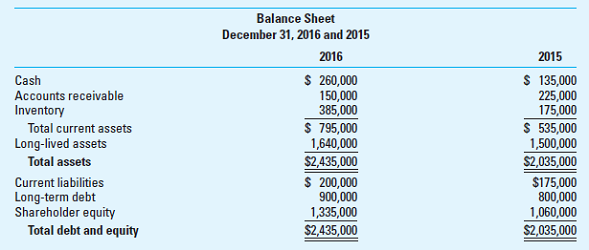

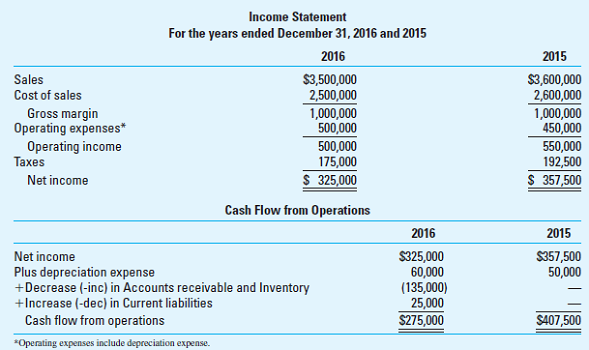

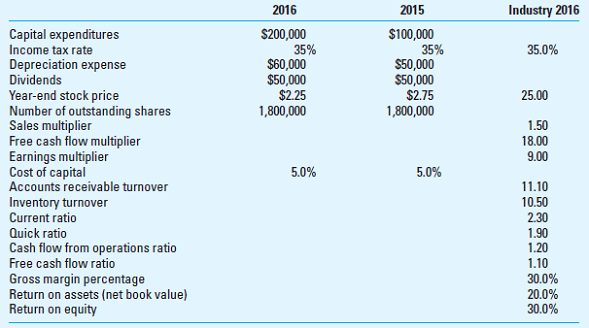

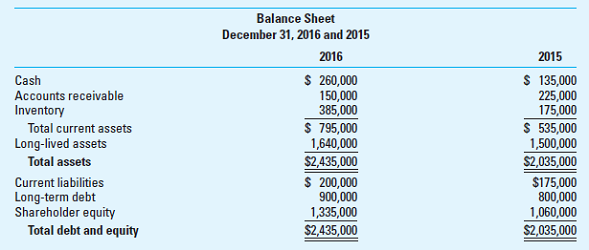

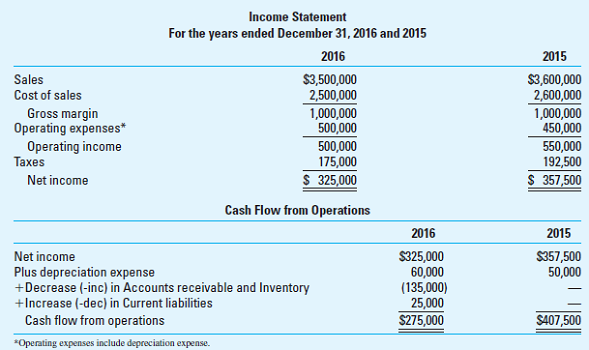

Business Analysis Williams Company is a manufacturer of auto parts having the following financial statements for 2015-2016.

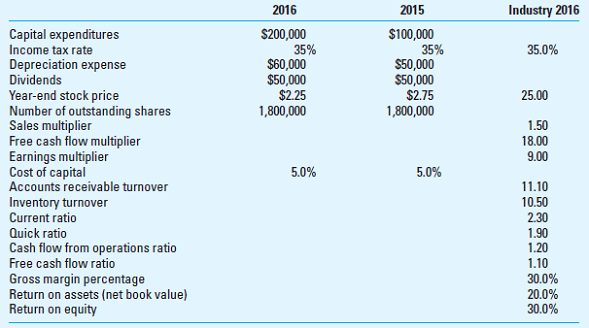

Additional financial information, including industry averages for 2016, where appropriate includes:

Required:

Calculate and interpret the financial ratios (per Exhibit 20.9) for Williams for both years. Since the calculation of many ratios requires the average balance in an account (e.g., average receivables is required in calculating receivables turnover), you may assume that the balances in these accounts in 2015 are the same as those in 2014.

EXHIBIT 20.9 Financial Ratio nalysis

Additional financial information, including industry averages for 2016, where appropriate includes:

Required:

Calculate and interpret the financial ratios (per Exhibit 20.9) for Williams for both years. Since the calculation of many ratios requires the average balance in an account (e.g., average receivables is required in calculating receivables turnover), you may assume that the balances in these accounts in 2015 are the same as those in 2014.

EXHIBIT 20.9 Financial Ratio nalysis

Explanation

In a sense to determine strategic advant...

Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255