Entrepreneurial Small Business 4th Edition by Jerome Katz ,Richard Green

Edition 4ISBN: 978-0078029424

Entrepreneurial Small Business 4th Edition by Jerome Katz ,Richard Green

Edition 4ISBN: 978-0078029424 Exercise 29

PARKER MOUNTAIN PRODUCTS, INC.

COMPANY HISTORY

The New England region of the United States includes a beautiful coastal stretch that extends from Maine to Rhode Island, through the states of New Hampshire, Massachusetts, and Connecticut. The area is famous for its summer tourism, which includes beaches, quaint villages and towns, restaurants, shops, historic sites and landmarks, and lobsters. Tens of thousands of people from around the world vacation in the area each year, especially during the summer season, which extends from Memorial Day to Labor Day.

Shortly after World War II, Ernest Parker returned to his hometown of Rochester, New Hampshire, and built a small factory that produces low-end glass and ceramic regional souvenirs. These products include wine glasses, general glassware, ceramic cups and bowls, and small platters. Each of these is decorated with a variety of painted images and words related to the specific coastal tourist towns and markets, that is, pictures of lobsters, seagulls, ocean waves, famous towns, and famous sites.

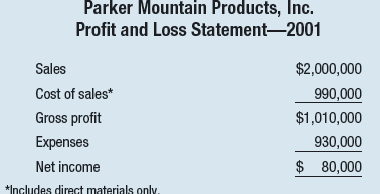

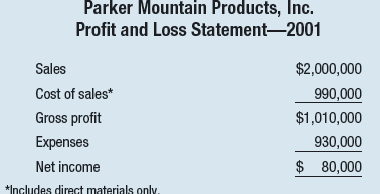

Ernest has provided steady employment for 35 production and support staff. The business has grown at a rate of about 5 percent per year (in sales). The most recent profit and loss statement is shown:

The entire production is sold through a small number of manufacturer's reps, wholesalers, and brokers. While the opportunity was always there to sell direct, Ernest chose to focus all his efforts on the production side of the business, allowing others to market, sell, and distribute the products to retail shops, hotels, and other vendors. The industry average or norm for profits is between 5 and 7 percent (net income to sales).

Chris and Ben are anxious to improve efficiency on the production side and to develop a variety of direct niche markets to complement their wholesale distribution on the marketing and sales side. The opportunity to add, drop, or shift the product mix, and to increase production and sales exists. In order to properly analyze and act on this, they have asked their bookkeeper to provide more specific production and cost data.

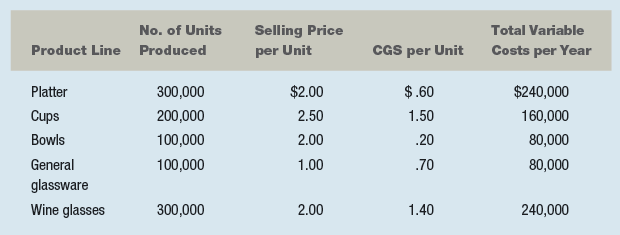

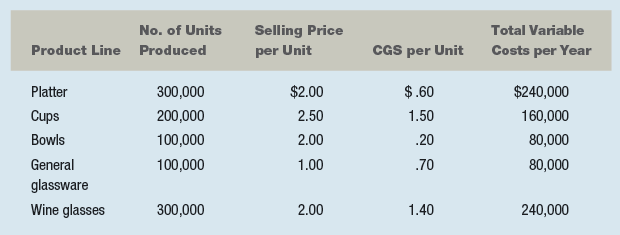

This information is presented below:

The total variable costs of $800,000 are assigned or charged to each product line based on the number of units produced. Total fixed costs for the factory are $80,000; selling and administrative costs for the total company are $50,000.

Chris and Ben have determined that the factory is now at 85 percent of capacity. They are certain that production can be increased without incurring any extra expense beyond direct materials.

They also know that the selling price could be increased by 15 percent as a result of a direct sales program. Their only uncertainty or fear is in disrupting the long-standing relationships that exist with the various manufacturers' reps, wholesalers, and brokers who have been able to sell all of the company's production for many years. They are afraid of "biting the hand that feeds them" by selling to an end user who currently buys from one of their own distributors.

As a first step, conduct a financial analysis of current operations by reformatting the income statement to include individual product lines as well as the total company. Analyze those data.

COMPANY HISTORY

The New England region of the United States includes a beautiful coastal stretch that extends from Maine to Rhode Island, through the states of New Hampshire, Massachusetts, and Connecticut. The area is famous for its summer tourism, which includes beaches, quaint villages and towns, restaurants, shops, historic sites and landmarks, and lobsters. Tens of thousands of people from around the world vacation in the area each year, especially during the summer season, which extends from Memorial Day to Labor Day.

Shortly after World War II, Ernest Parker returned to his hometown of Rochester, New Hampshire, and built a small factory that produces low-end glass and ceramic regional souvenirs. These products include wine glasses, general glassware, ceramic cups and bowls, and small platters. Each of these is decorated with a variety of painted images and words related to the specific coastal tourist towns and markets, that is, pictures of lobsters, seagulls, ocean waves, famous towns, and famous sites.

Ernest has provided steady employment for 35 production and support staff. The business has grown at a rate of about 5 percent per year (in sales). The most recent profit and loss statement is shown:

The entire production is sold through a small number of manufacturer's reps, wholesalers, and brokers. While the opportunity was always there to sell direct, Ernest chose to focus all his efforts on the production side of the business, allowing others to market, sell, and distribute the products to retail shops, hotels, and other vendors. The industry average or norm for profits is between 5 and 7 percent (net income to sales).

Chris and Ben are anxious to improve efficiency on the production side and to develop a variety of direct niche markets to complement their wholesale distribution on the marketing and sales side. The opportunity to add, drop, or shift the product mix, and to increase production and sales exists. In order to properly analyze and act on this, they have asked their bookkeeper to provide more specific production and cost data.

This information is presented below:

The total variable costs of $800,000 are assigned or charged to each product line based on the number of units produced. Total fixed costs for the factory are $80,000; selling and administrative costs for the total company are $50,000.

Chris and Ben have determined that the factory is now at 85 percent of capacity. They are certain that production can be increased without incurring any extra expense beyond direct materials.

They also know that the selling price could be increased by 15 percent as a result of a direct sales program. Their only uncertainty or fear is in disrupting the long-standing relationships that exist with the various manufacturers' reps, wholesalers, and brokers who have been able to sell all of the company's production for many years. They are afraid of "biting the hand that feeds them" by selling to an end user who currently buys from one of their own distributors.

As a first step, conduct a financial analysis of current operations by reformatting the income statement to include individual product lines as well as the total company. Analyze those data.

Explanation

Mr. C and B are planning to improve effi...

Entrepreneurial Small Business 4th Edition by Jerome Katz ,Richard Green

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255