Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Edition 16ISBN: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Edition 16ISBN: 978-0077862381 Exercise 60

Examining Home Depot's Capital Structure

To answer the following questions use the financial statements for Home Depot , Inc , inAppendixA at the end of the textbook

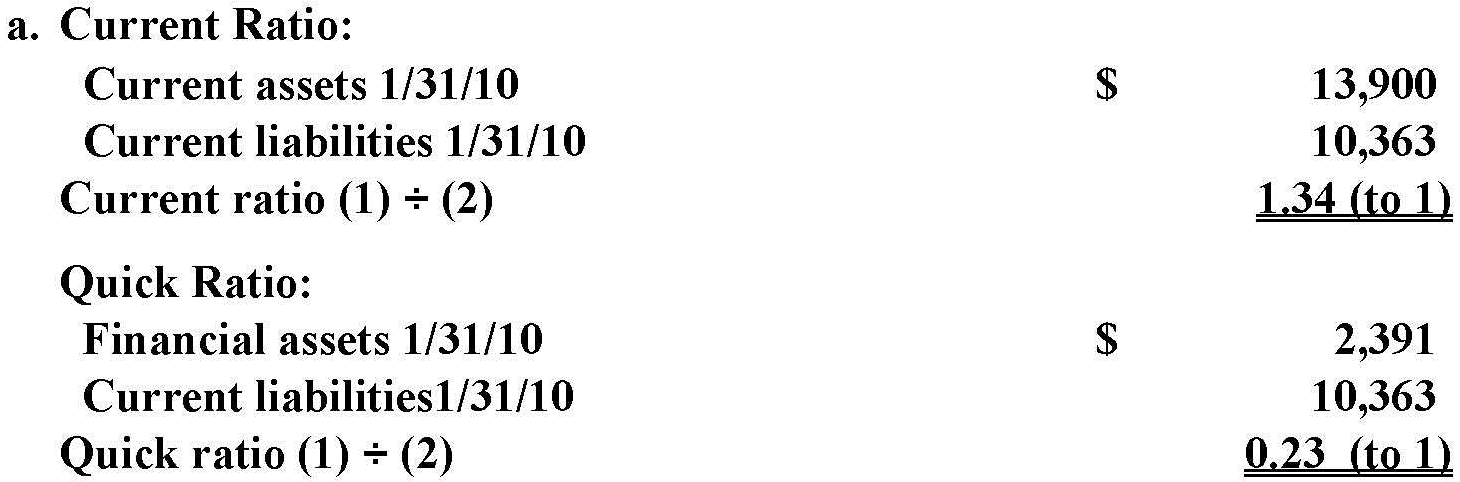

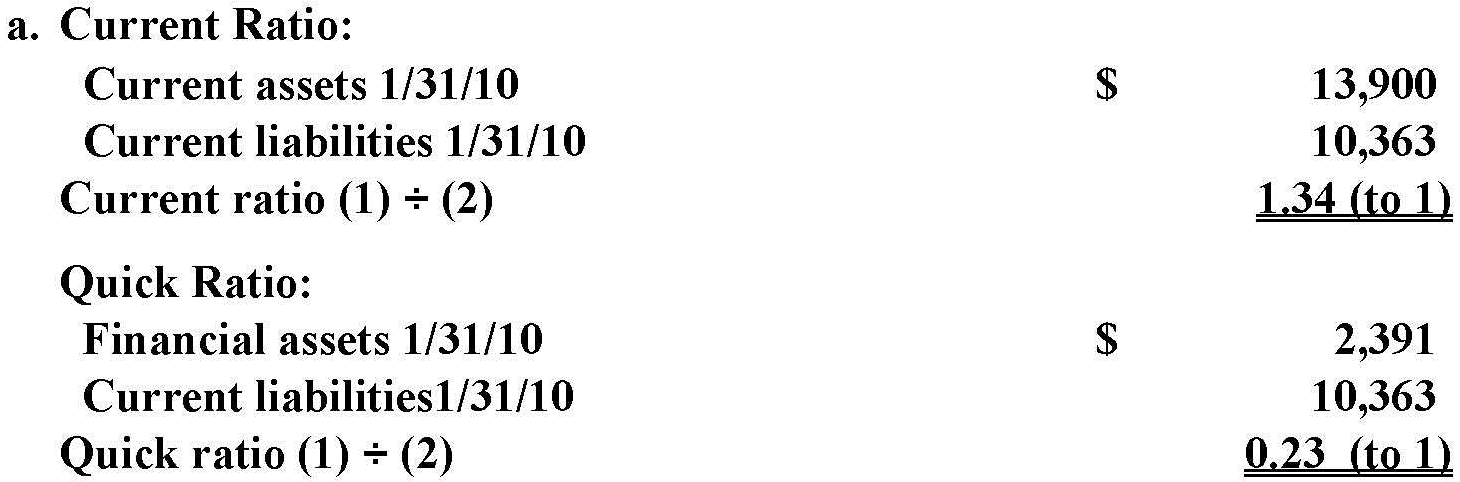

a.ompute the company's current ratio and quick ratio for the most recent year reported.o these ratios provide support that Home Depot is able to repay its current liabilities asthey , come due Explain.

b.ompute the company's debt ratio.oes Home Depot appear to have excessive debt Explain.

c.xamine the company's statement ofcash flows.oes Home Depot's cash flow from operating activities appear adequate tocover itscurrent liabilities as they come due Explain.

To answer the following questions use the financial statements for Home Depot , Inc , inAppendixA at the end of the textbook

a.ompute the company's current ratio and quick ratio for the most recent year reported.o these ratios provide support that Home Depot is able to repay its current liabilities asthey , come due Explain.

b.ompute the company's debt ratio.oes Home Depot appear to have excessive debt Explain.

c.xamine the company's statement ofcash flows.oes Home Depot's cash flow from operating activities appear adequate tocover itscurrent liabilities as they come due Explain.

Explanation

Current Ratio:

Current ratio is the rat...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255