Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Edition 16ISBN: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Edition 16ISBN: 978-0077862381 Exercise 18

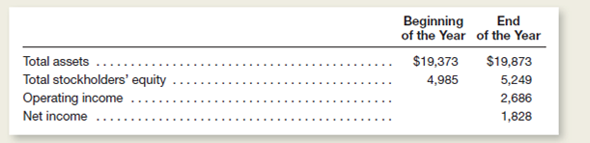

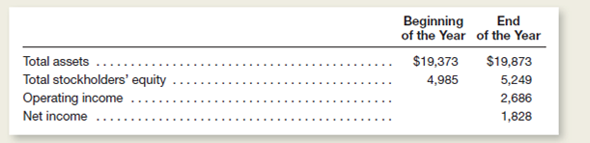

Shown below are selected data from a recent annual report of Kimberly-Clark Corporation , a large consumer products provider.Dollar amounts are in millions.)

a.ompute for the year Kimberly-Clark 's return on average total assets.Round computations to the nearest two-tenths of 1 percent.)

b.ompute for the year Kimberly-Clark 's return on average total stockholders' equity.Round computations to the nearest two-tenths of 1 percent.)

c.hat is the most likely explanation why Kimberly-Clark 's total stockholders' equity for the year increased

a.ompute for the year Kimberly-Clark 's return on average total assets.Round computations to the nearest two-tenths of 1 percent.)

b.ompute for the year Kimberly-Clark 's return on average total stockholders' equity.Round computations to the nearest two-tenths of 1 percent.)

c.hat is the most likely explanation why Kimberly-Clark 's total stockholders' equity for the year increased

Explanation

Return on investment (ROI) is the profit...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255