Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Edition 16ISBN: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Edition 16ISBN: 978-0077862381 Exercise 30

S.-based company, IBC, has wholly owned subsidiaries across the world.BC is in the medical products market and sources most of its sales of medical devices from the United States, but sells most of those devices to the European market.

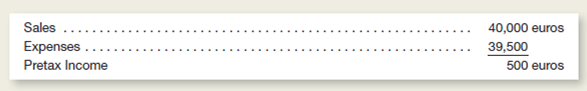

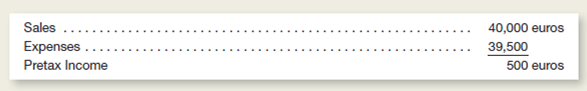

The president and board members of IBC believe the managers of IBC's wholly owned countrylevel subsidiaries are best motivated and rewarded with both annual salaries and annual bonuses.he bonuses are calculated as a predetermined percentage of pretax annual income.ichael O'Brien, the president of IBC of Ireland, has worked hard to make the Ireland subsidiary profitable, although sales have lagged projections.e is looking forward to receiving his annual bonus, which is calculated as a predetermined percentage of this year's pretax annual income earned by IBC of Ireland. condensed income statement for IBC of Ireland for the most recent year is as follows (amounts in thousands of euros).

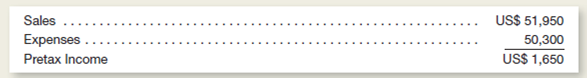

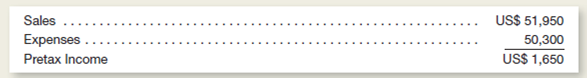

The U.S.eadquarters financial group translates each of its wholly owned subsidiary's results into U.S.ollars for evaluation.fter translating the euros income statement into U.S.ollars, the condensed income statement for IBC of Ireland is as follows (amounts in thousands of dollars):

Instructions

a.alculate the bonus based on the subsidiary's results in euros and U.S.ollars.ranslate the euro result to U.S.ollars using a current exchange rate.ompare the results.

b.alculate the average exchange rate used to translate the euro statement into the U.S.ollarbased statement for: (1) Sales and (2) Expenses.

c.efer to the answers in parts a.nd b.se those answers to explain why or how IBC of Ireland's euro pretax income differs from the U.S.-dollar pretax income.

d.xplain one reason why the dollar-based pretax income would be appropriate for evaluating Michael O'Brien and one reason why the euros-based pretax income would be appropriate.hich would you choose and why

The president and board members of IBC believe the managers of IBC's wholly owned countrylevel subsidiaries are best motivated and rewarded with both annual salaries and annual bonuses.he bonuses are calculated as a predetermined percentage of pretax annual income.ichael O'Brien, the president of IBC of Ireland, has worked hard to make the Ireland subsidiary profitable, although sales have lagged projections.e is looking forward to receiving his annual bonus, which is calculated as a predetermined percentage of this year's pretax annual income earned by IBC of Ireland. condensed income statement for IBC of Ireland for the most recent year is as follows (amounts in thousands of euros).

The U.S.eadquarters financial group translates each of its wholly owned subsidiary's results into U.S.ollars for evaluation.fter translating the euros income statement into U.S.ollars, the condensed income statement for IBC of Ireland is as follows (amounts in thousands of dollars):

Instructions

a.alculate the bonus based on the subsidiary's results in euros and U.S.ollars.ranslate the euro result to U.S.ollars using a current exchange rate.ompare the results.

b.alculate the average exchange rate used to translate the euro statement into the U.S.ollarbased statement for: (1) Sales and (2) Expenses.

c.efer to the answers in parts a.nd b.se those answers to explain why or how IBC of Ireland's euro pretax income differs from the U.S.-dollar pretax income.

d.xplain one reason why the dollar-based pretax income would be appropriate for evaluating Michael O'Brien and one reason why the euros-based pretax income would be appropriate.hich would you choose and why

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255