Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Edition 16ISBN: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Edition 16ISBN: 978-0077862381 Exercise 58

Exchange Rates and Product Decisions

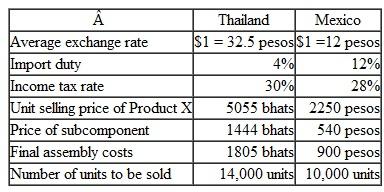

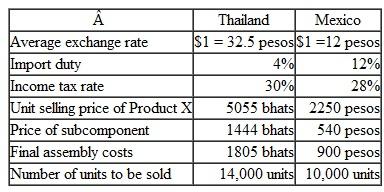

Haliday Company has manufacturing subsidiaries in Thailand and Mexico.t is considering shipping the subcomponents of Product X to one or the other of these countries for final assembly.he final product will be sold in the country where it is assembled.ther information is as follows:

In both countries, the import duties are based on the value of the incoming goods in the receiving country's currency.

Instructions

a.or each country, prepare an income statement on a per-unit basis denominated in that country's currency.

b.n which country would the highest profit per unit (in dollars) be earned

c.n which country would the highest total profit (in dollars) be earned

Haliday Company has manufacturing subsidiaries in Thailand and Mexico.t is considering shipping the subcomponents of Product X to one or the other of these countries for final assembly.he final product will be sold in the country where it is assembled.ther information is as follows:

In both countries, the import duties are based on the value of the incoming goods in the receiving country's currency.

Instructions

a.or each country, prepare an income statement on a per-unit basis denominated in that country's currency.

b.n which country would the highest profit per unit (in dollars) be earned

c.n which country would the highest total profit (in dollars) be earned

Explanation

(a) Income statement on a per unit basis...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255