Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Edition 10ISBN: 9781285439396

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Edition 10ISBN: 9781285439396 Exercise 30

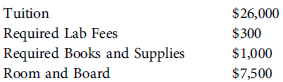

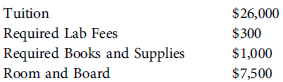

Cathy Coed is a full-time senior student at Big Research University (BRU). Cathy is considered by most as a brilliant student and has been given a $35,000-per-year scholarship. In the current year, Cathy pays the following amounts to attend BRU:

What are the tax consequences (i.e., how much is income) of the $35,000 current year's scholarship to Cathy In answering this case, use an online tax service with only the Internal Revenue Code database selected. State your keywords and which online tax service you used to arrive at your answer.

What are the tax consequences (i.e., how much is income) of the $35,000 current year's scholarship to Cathy In answering this case, use an online tax service with only the Internal Revenue Code database selected. State your keywords and which online tax service you used to arrive at your answer.

Explanation

US Federal Tax Laws: The very first step...

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255