Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Edition 10ISBN: 9781285439396

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Edition 10ISBN: 9781285439396 Exercise 35

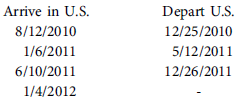

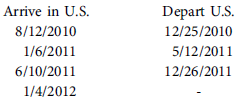

Anh Nguyen, a single 24 year old, recently completed her undergraduate degree in accounting at Vietnamese National University in Hanoi. She applied to and was accepted into Southern California University, located in Burbank, California, to pursue a master's degree in taxation. She received her F-1 student visa and arrived at Los Angeles International Airport in the fall of 2010 and started her courses almost immediately. She was extremely excited because this was her first trip to the United States. Although Anh was an exceptionally bright student, she was thoroughly enjoying the southern California lifestyle and took only enough courses to maintain her full-time-student classification. As a result, it was going to take Anh a little longer to complete her master's degree in tax. Although Anh missed her family and friends back in Vietnam, international travel was very expensive and so she returned home only on limited occasions. Her international travel schedule was as follows:

Anh remained in the United States from January 4, 2012, through the end of 2013. During 2013, Anh managed to get an on-campus job that paid her $6,000 as compensation for working as a graduate assistant assisting SCU Professor Ira Ess with his research and grading.

Anh noticed that she had income tax and FICA taxes withheld from her paycheck. When she received her Form W-2 statement in early 2014, she realized that she needed to file a U.S. tax return to get back her withholding.

Prepare a memo that addresses three issues: (1) How is Anh going to be treated for U.S. tax residency purposes (2) Is Anh's income from her student job taxable in the United States (3) Is Anh subject to FICA taxes Be sure and support your memo with primary sources.

Anh remained in the United States from January 4, 2012, through the end of 2013. During 2013, Anh managed to get an on-campus job that paid her $6,000 as compensation for working as a graduate assistant assisting SCU Professor Ira Ess with his research and grading.

Anh noticed that she had income tax and FICA taxes withheld from her paycheck. When she received her Form W-2 statement in early 2014, she realized that she needed to file a U.S. tax return to get back her withholding.

Prepare a memo that addresses three issues: (1) How is Anh going to be treated for U.S. tax residency purposes (2) Is Anh's income from her student job taxable in the United States (3) Is Anh subject to FICA taxes Be sure and support your memo with primary sources.

Explanation

US Federal Tax Laws: The very first step...

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255