Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Edition 10ISBN: 9781285439396

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Edition 10ISBN: 9781285439396 Exercise 21

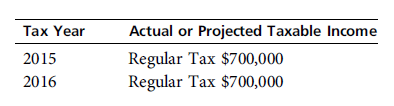

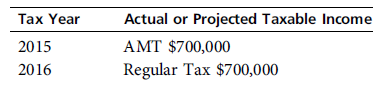

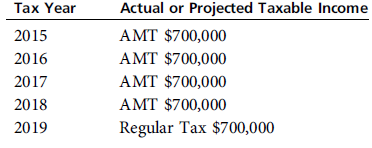

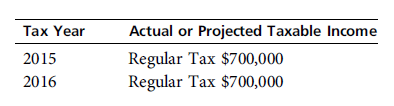

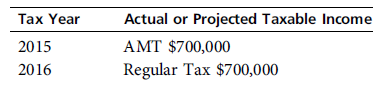

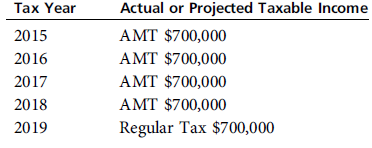

Should Harris Corporation accelerate $100,000 of gross income into 2014, its first year subject to the AMT Harris is subject to a 14 percent cost of capital. The corporate AMT rate is a flat 20 percent, and Harris Corporation exceeds the annual AMT exemption phase-out level of income.

a.

b.

.

a.

b.

.

Explanation

Alternate minimum tax

When property is ...

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255