Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Edition 10ISBN: 9781285439396

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Edition 10ISBN: 9781285439396 Exercise 2

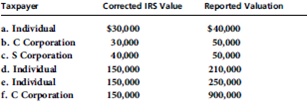

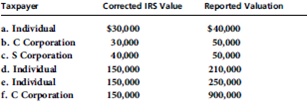

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable-contribution property. In each case, assume a marginal income tax rate of 35 percent.

Explanation

Over-valuation penalty:

It applies when...

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255